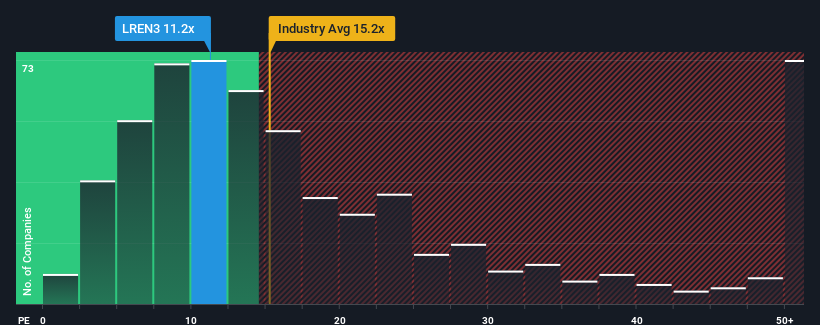

When close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 8x, you may consider Lojas Renner S.A. (BVMF:LREN3) as a stock to potentially avoid with its 11.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been advantageous for Lojas Renner as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Lojas Renner

How Is Lojas Renner's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Lojas Renner's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. Pleasingly, EPS has also lifted 88% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the market is forecast to expand by 14% each year, which is not materially different.

With this information, we find it interesting that Lojas Renner is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Lojas Renner's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Lojas Renner has 2 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LREN3

Lojas Renner

Operates as a fashion and lifestyle company in Brazil, Argentina, and Uruguay.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives