- Brazil

- /

- Specialty Stores

- /

- BOVESPA:LREN3

0.3% earnings growth over 5 years has not materialized into gains for Lojas Renner (BVMF:LREN3) shareholders over that period

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Lojas Renner S.A. (BVMF:LREN3) share price dropped 63% in the last half decade. That's an unpleasant experience for long term holders. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

Since Lojas Renner has shed R$642m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Lojas Renner actually managed to increase EPS by an average of 1.7% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, five years ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

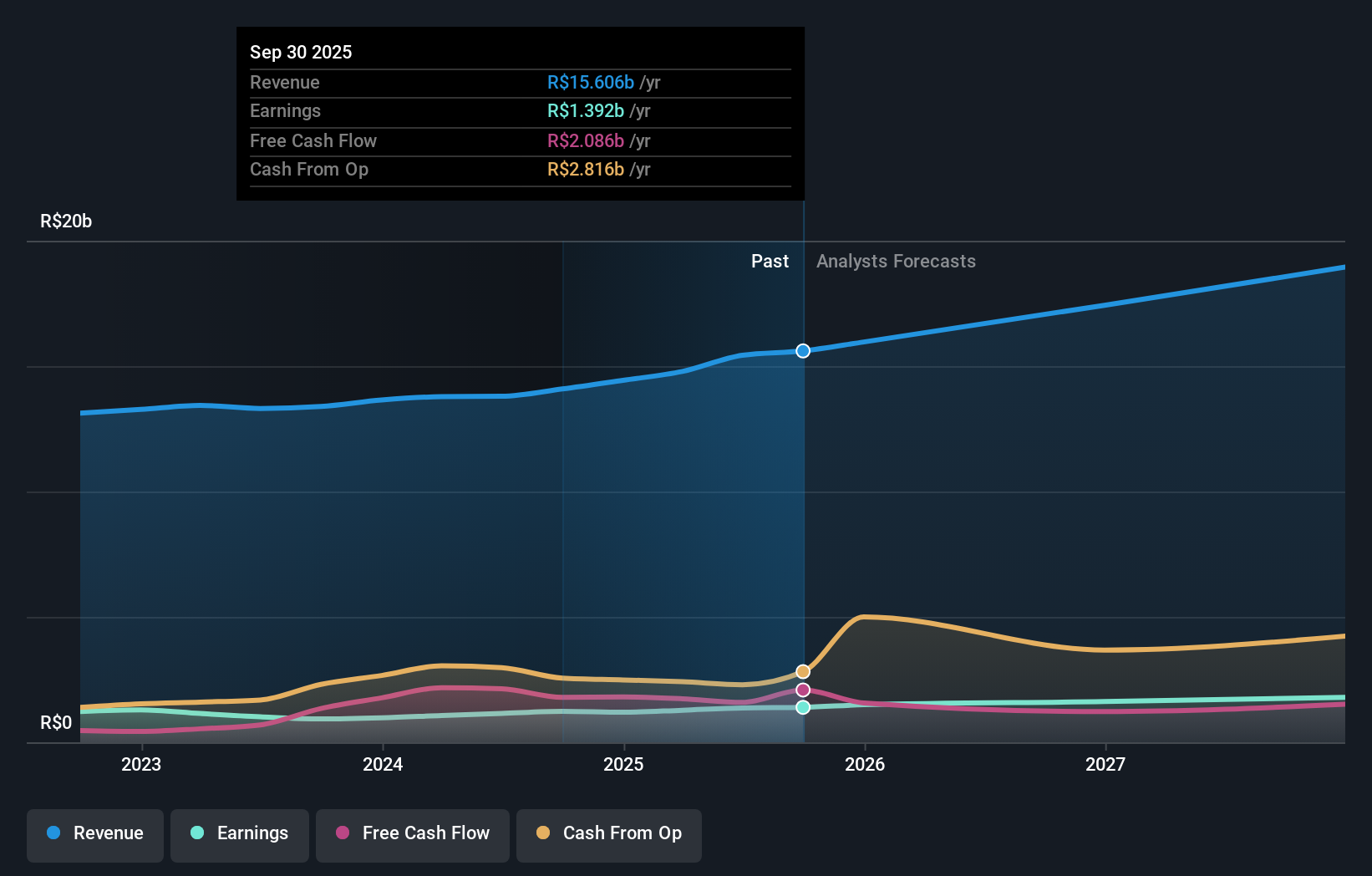

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Lojas Renner is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Lojas Renner the TSR over the last 5 years was -55%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Lojas Renner provided a TSR of 11% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Lojas Renner better, we need to consider many other factors. Take risks, for example - Lojas Renner has 1 warning sign we think you should be aware of.

Of course Lojas Renner may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LREN3

Lojas Renner

Operates as a fashion and lifestyle company in Brazil, Argentina, and Uruguay.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion