- Brazil

- /

- Real Estate

- /

- BOVESPA:MDNE3

Investors in Moura Dubeux Engenharia (BVMF:MDNE3) from a year ago are still down 31%, even after 11% gain this past week

Moura Dubeux Engenharia S.A. (BVMF:MDNE3) shareholders should be happy to see the share price up 13% in the last quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 31% in the last year, significantly under-performing the market.

While the last year has been tough for Moura Dubeux Engenharia shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Moura Dubeux Engenharia

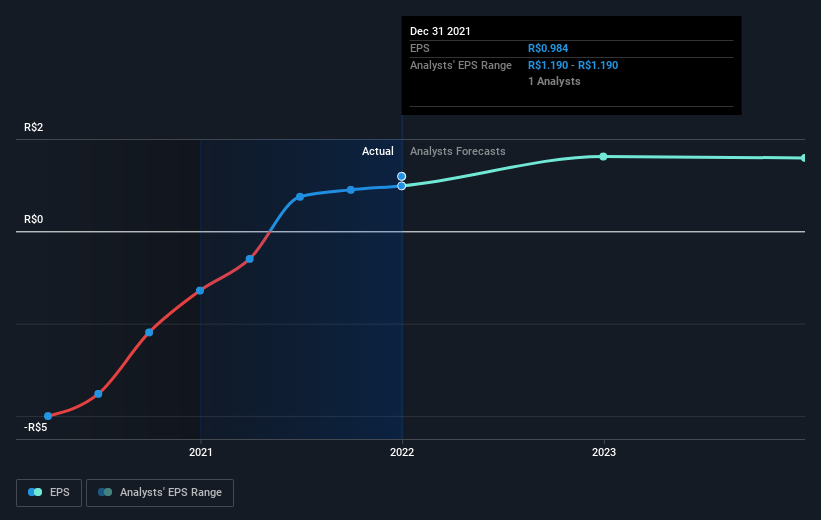

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Moura Dubeux Engenharia managed to increase earnings per share from a loss to a profit, over the last 12 months.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Moura Dubeux Engenharia has grown profits over the years, but the future is more important for shareholders. This free interactive report on Moura Dubeux Engenharia's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Moura Dubeux Engenharia shareholders are down 31% for the year, even worse than the market loss of 2.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Putting aside the last twelve months, it's good to see the share price has rebounded by 13%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Moura Dubeux Engenharia better, we need to consider many other factors. For instance, we've identified 1 warning sign for Moura Dubeux Engenharia that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MDNE3

Moura Dubeux Engenharia

Provides real estate development services in Brazil.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives