- Brazil

- /

- Real Estate

- /

- BOVESPA:LOGG3

The LOG Commercial Properties e Participações (BVMF:LOGG3) Share Price Has Gained 15% And Shareholders Are Hoping For More

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the LOG Commercial Properties e Participações S.A. (BVMF:LOGG3) share price is 15% higher than it was a year ago, much better than the market return of around 5.6% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! We'll need to follow LOG Commercial Properties e Participações for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for LOG Commercial Properties e Participações

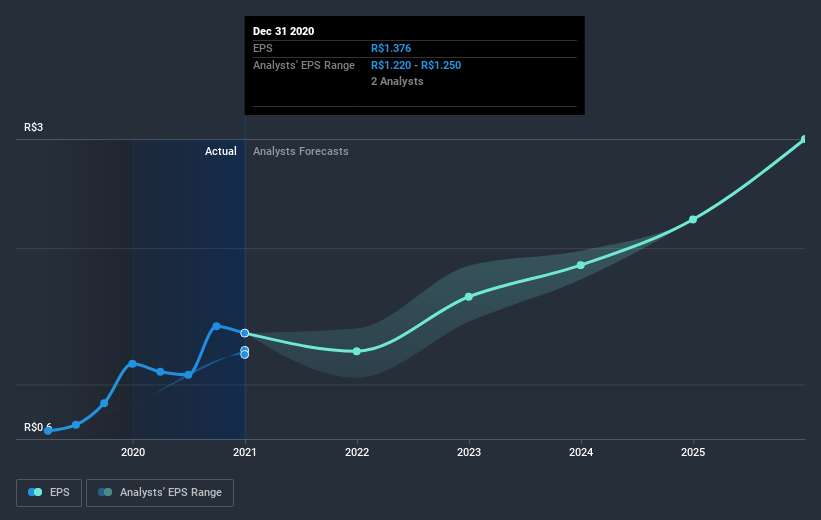

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

LOG Commercial Properties e Participações was able to grow EPS by 20% in the last twelve months. It's fair to say that the share price gain of 15% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about LOG Commercial Properties e Participações as it was before. This could be an opportunity.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that LOG Commercial Properties e Participações has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

LOG Commercial Properties e Participações boasts a total shareholder return of 16% for the last year (that includes the dividends) . Unfortunately the share price is down 7.5% over the last quarter. Shorter term share price moves often don't signify much about the business itself. It's always interesting to track share price performance over the longer term. But to understand LOG Commercial Properties e Participações better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with LOG Commercial Properties e Participações .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade LOG Commercial Properties e Participações, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:LOGG3

LOG Commercial Properties e Participações

LOG Commercial Properties e Participações S.A.

Proven track record with slight risk.

Market Insights

Community Narratives