- Brazil

- /

- Real Estate

- /

- BOVESPA:IGTI3

I Ran A Stock Scan For Earnings Growth And Jereissati Participações (BVMF:JPSA3) Passed With Ease

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Jereissati Participações (BVMF:JPSA3). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Jereissati Participações

How Quickly Is Jereissati Participações Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Jereissati Participações's stratospheric annual EPS growth of 42%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Jereissati Participações's EBIT margins have fallen over the last twelve months, but the flat revenue sends a message of stability. Does that sound particularly bullish? No, it does not.

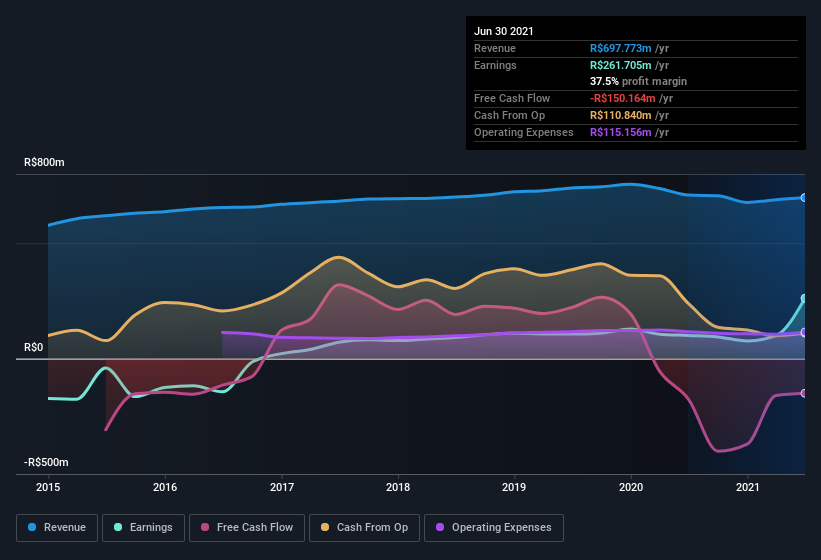

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Jereissati Participações's balance sheet strength, before getting too excited.

Are Jereissati Participações Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Jereissati Participações insiders have a significant amount of capital invested in the stock. To be specific, they have R$120m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 4.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Jereissati Participações To Your Watchlist?

Jereissati Participações's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Jereissati Participações is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Before you take the next step you should know about the 2 warning signs for Jereissati Participações (1 is concerning!) that we have uncovered.

Although Jereissati Participações certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:IGTI3

Iguatemi

Engages in the commercial exploration and planning of shopping centers in Brazil.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026