- Brazil

- /

- Real Estate

- /

- BOVESPA:HBRE3

HBR Realty Empreendimentos Imobiliários S.A.'s (BVMF:HBRE3) 27% Price Boost Is Out Of Tune With Earnings

HBR Realty Empreendimentos Imobiliários S.A. (BVMF:HBRE3) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 45% over that time.

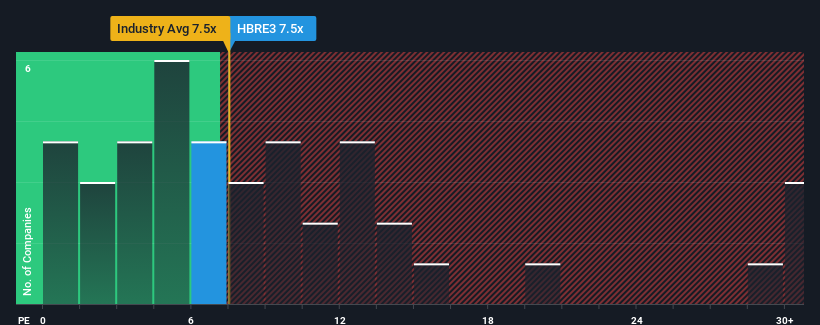

Even after such a large jump in price, there still wouldn't be many who think HBR Realty Empreendimentos Imobiliários' price-to-earnings (or "P/E") ratio of 7.5x is worth a mention when the median P/E in Brazil is similar at about 8x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, HBR Realty Empreendimentos Imobiliários' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for HBR Realty Empreendimentos Imobiliários

How Is HBR Realty Empreendimentos Imobiliários' Growth Trending?

HBR Realty Empreendimentos Imobiliários' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 64%. This means it has also seen a slide in earnings over the longer-term as EPS is down 69% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 245% over the next year. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we find it concerning that HBR Realty Empreendimentos Imobiliários is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Final Word

HBR Realty Empreendimentos Imobiliários' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that HBR Realty Empreendimentos Imobiliários currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 6 warning signs for HBR Realty Empreendimentos Imobiliários (2 are potentially serious!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if HBR Realty Empreendimentos Imobiliários might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HBRE3

HBR Realty Empreendimentos Imobiliários

HBR Realty Empreendimentos Imobiliários S.A.

Medium-low risk with limited growth.

Market Insights

Community Narratives