- Brazil

- /

- Interactive Media and Services

- /

- BOVESPA:ENJU3

Investors Give Enjoei S.A. (BVMF:ENJU3) Shares A 25% Hiding

Enjoei S.A. (BVMF:ENJU3) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

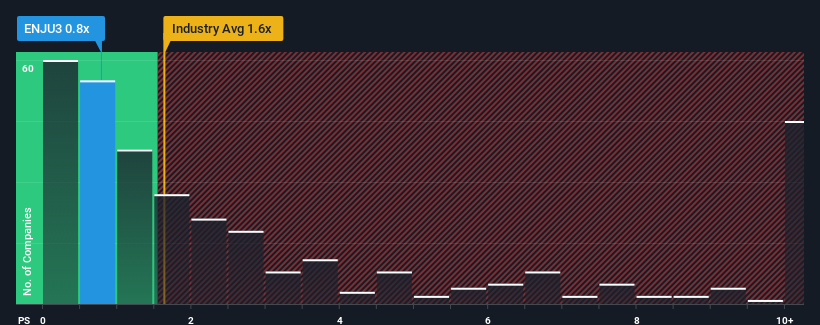

Following the heavy fall in price, Enjoei's price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Interactive Media and Services industry in Brazil, where around half of the companies have P/S ratios above 1.6x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Enjoei

How Has Enjoei Performed Recently?

With revenue growth that's superior to most other companies of late, Enjoei has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Enjoei's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Enjoei would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 36% last year. Pleasingly, revenue has also lifted 150% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 27% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's peculiar that Enjoei's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Enjoei's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Enjoei's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Enjoei is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If you're unsure about the strength of Enjoei's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Enjoei might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:ENJU3

Enjoei

Operates a marketplace platform for the purchase and sale of used products in Brazil.

Flawless balance sheet and fair value.

Market Insights

Community Narratives