Top Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As global markets soar to new highs following the Federal Reserve's first rate cut in over four years, investors are increasingly looking for opportunities in growth companies with strong insider ownership. In such a buoyant market environment, stocks with significant insider stakes often signal confidence from those who know the business best, making them attractive options for those seeking robust growth potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| On Holding (NYSE:ONON) | 28.4% | 24.2% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

Let's review some notable picks from our screened stocks.

Suzano (BOVESPA:SUZB3)

Simply Wall St Growth Rating: ★★★★☆☆

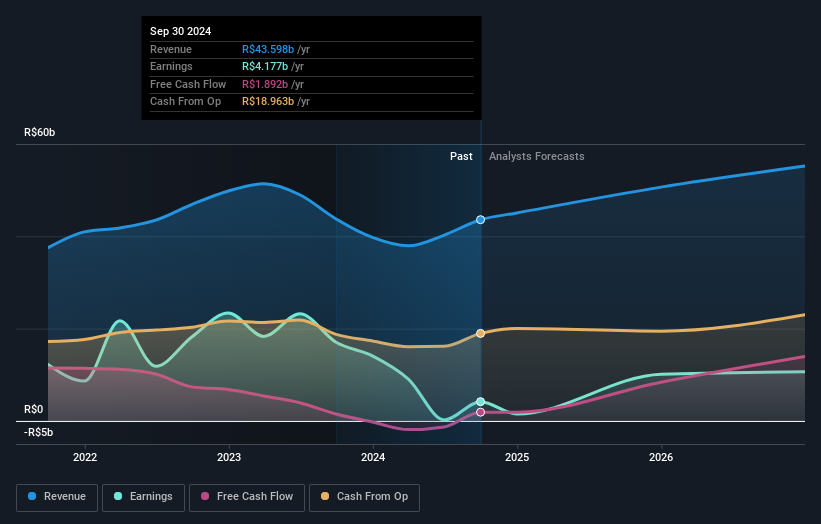

Overview: Suzano S.A. produces and sells eucalyptus pulp and paper products in Brazil and internationally, with a market cap of R$68.17 billion.

Operations: The company's revenue segments are comprised of R$30.97 billion from pulp and R$9.30 billion from paper products.

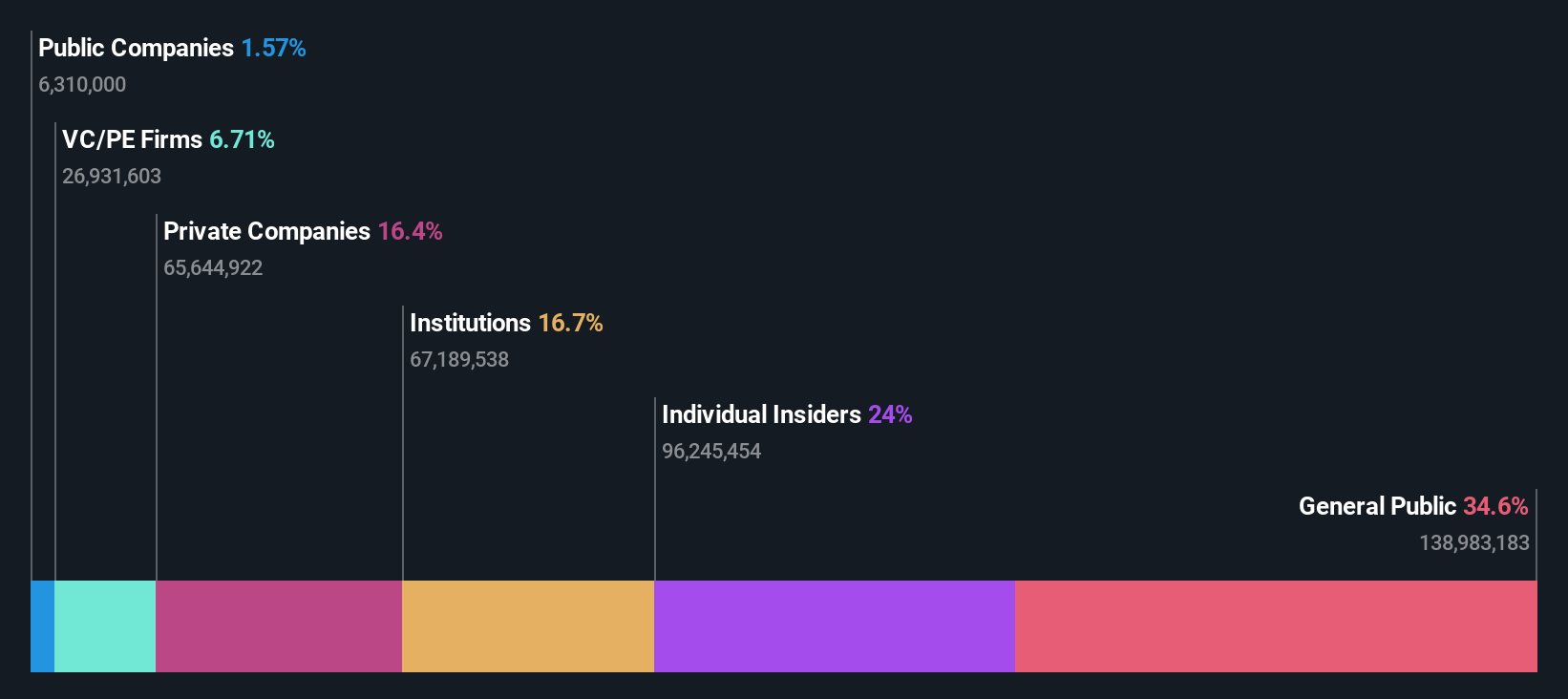

Insider Ownership: 15.6%

Earnings Growth Forecast: 33.6% p.a.

Suzano, a growth company with high insider ownership, is navigating a challenging financial landscape. Despite reporting a net loss of BRL 3.77 billion for Q2 2024 and lower profit margins compared to last year, the company's earnings are forecast to grow significantly at 33.58% annually over the next three years. Recent board meetings focused on strategic mergers and share buybacks indicate proactive management efforts to bolster shareholder value amidst fluctuating market conditions.

- Unlock comprehensive insights into our analysis of Suzano stock in this growth report.

- In light of our recent valuation report, it seems possible that Suzano is trading behind its estimated value.

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smartsens Technology (Shanghai) Co., Ltd. (SHSE:688213) specializes in the design and manufacture of CMOS image sensors, with a market cap of CN¥18.15 billion.

Operations: Smartsens Technology (Shanghai) generates revenue primarily from Semiconductor Integrated Circuit Chips, amounting to CN¥4.24 billion.

Insider Ownership: 24.4%

Earnings Growth Forecast: 50.2% p.a.

Smartsens Technology (Shanghai) has demonstrated robust growth, with half-year sales reaching CNY 2.46 billion, a significant increase from CNY 1.07 billion last year. The company turned profitable, reporting a net income of CNY 149.8 million compared to a prior loss of CNY 66.34 million. Analysts forecast annual revenue growth of 27.7% and earnings growth of over 50%, outpacing the broader Chinese market's expectations, indicating strong future prospects for this high insider ownership firm.

- Click to explore a detailed breakdown of our findings in Smartsens Technology (Shanghai)'s earnings growth report.

- According our valuation report, there's an indication that Smartsens Technology (Shanghai)'s share price might be on the expensive side.

Shenzhen Capchem Technology (SZSE:300037)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Capchem Technology Co., Ltd. researches, develops, produces, sells, and services electronic chemicals and functional materials in China with a market cap of CN¥23.63 billion.

Operations: The company's revenue segments include the research, development, production, sales, and servicing of electronic chemicals and functional materials in China.

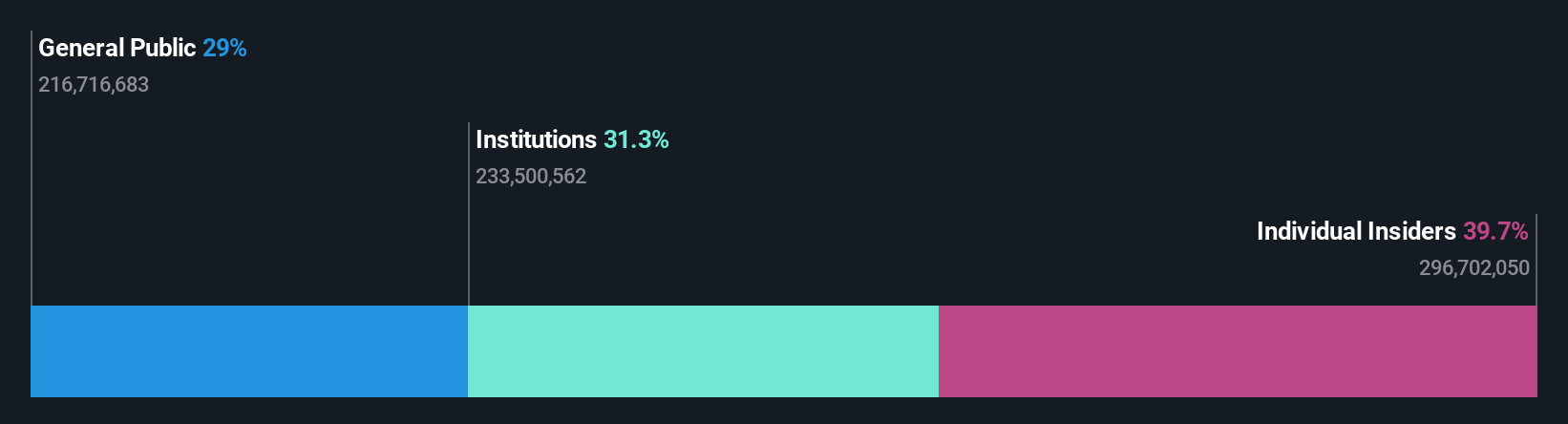

Insider Ownership: 39.4%

Earnings Growth Forecast: 27.6% p.a.

Shenzhen Capchem Technology is experiencing strong growth, with revenue forecasted to increase by 20.4% annually, outpacing the broader Chinese market. Despite a recent dip in net income to CNY 415.8 million for H1 2024, earnings are expected to grow significantly at 27.6% per year over the next three years. The company completed a share buyback worth CNY 49.98 million and maintains high insider ownership, reflecting confidence in its long-term potential despite current challenges.

- Dive into the specifics of Shenzhen Capchem Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Shenzhen Capchem Technology implies its share price may be too high.

Turning Ideas Into Actions

- Investigate our full lineup of 1521 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300037

Shenzhen Capchem Technology

Researches and develops, produces, sells, and services electronic chemicals products and functional materials in China and internationally.

High growth potential with excellent balance sheet.