Irani Papel e Embalagem S.A. Beat Revenue Forecasts By 6.7%: Here's What Analysts Are Forecasting Next

It's been a good week for Irani Papel e Embalagem S.A. (BVMF:RANI3) shareholders, because the company has just released its latest second-quarter results, and the shares gained 3.9% to R$8.48. Results overall were respectable, with statutory earnings of R$0.36 per share roughly in line with what the analysts had forecast. Revenues of R$403m came in 6.7% ahead of analyst predictions. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Irani Papel e Embalagem

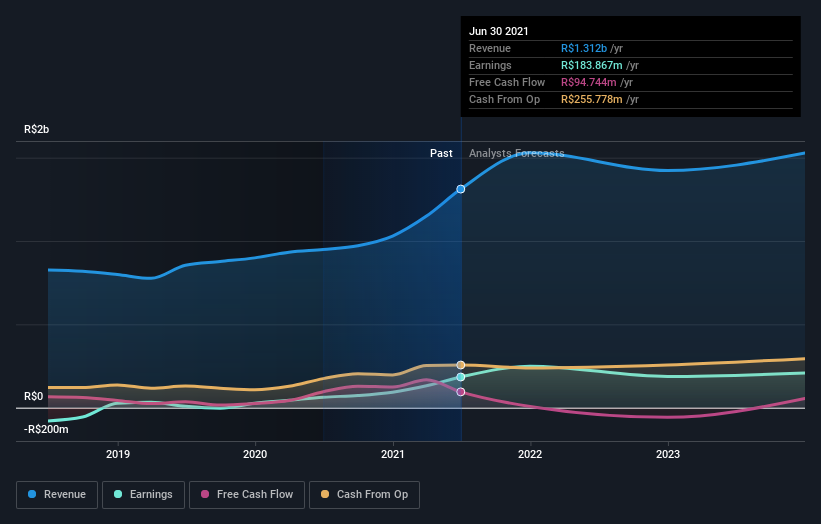

After the latest results, the two analysts covering Irani Papel e Embalagem are now predicting revenues of R$1.53b in 2021. If met, this would reflect a decent 17% improvement in sales compared to the last 12 months. Per-share earnings are expected to surge 34% to R$0.97. Before this earnings report, the analysts had been forecasting revenues of R$1.48b and earnings per share (EPS) of R$0.55 in 2021. There's been a pretty noticeable increase in sentiment, with the analysts upgrading revenues and making a great increase in earnings per share in particular.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 26% to R$9.70per share.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Irani Papel e Embalagem's growth to accelerate, with the forecast 36% annualised growth to the end of 2021 ranking favourably alongside historical growth of 9.1% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 3.9% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Irani Papel e Embalagem is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Irani Papel e Embalagem following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have analyst estimates for Irani Papel e Embalagem going out as far as 2023, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 4 warning signs for Irani Papel e Embalagem (1 is potentially serious) you should be aware of.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:RANI3

Irani Papel e Embalagem

Manufactures and sells corrugated cardboard and packaging papers in Brazil and internationally.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.