- Brazil

- /

- Metals and Mining

- /

- BOVESPA:PMAM3

Paranapanema S.A.'s (BVMF:PMAM3) 32% Share Price Plunge Could Signal Some Risk

Paranapanema S.A. (BVMF:PMAM3) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

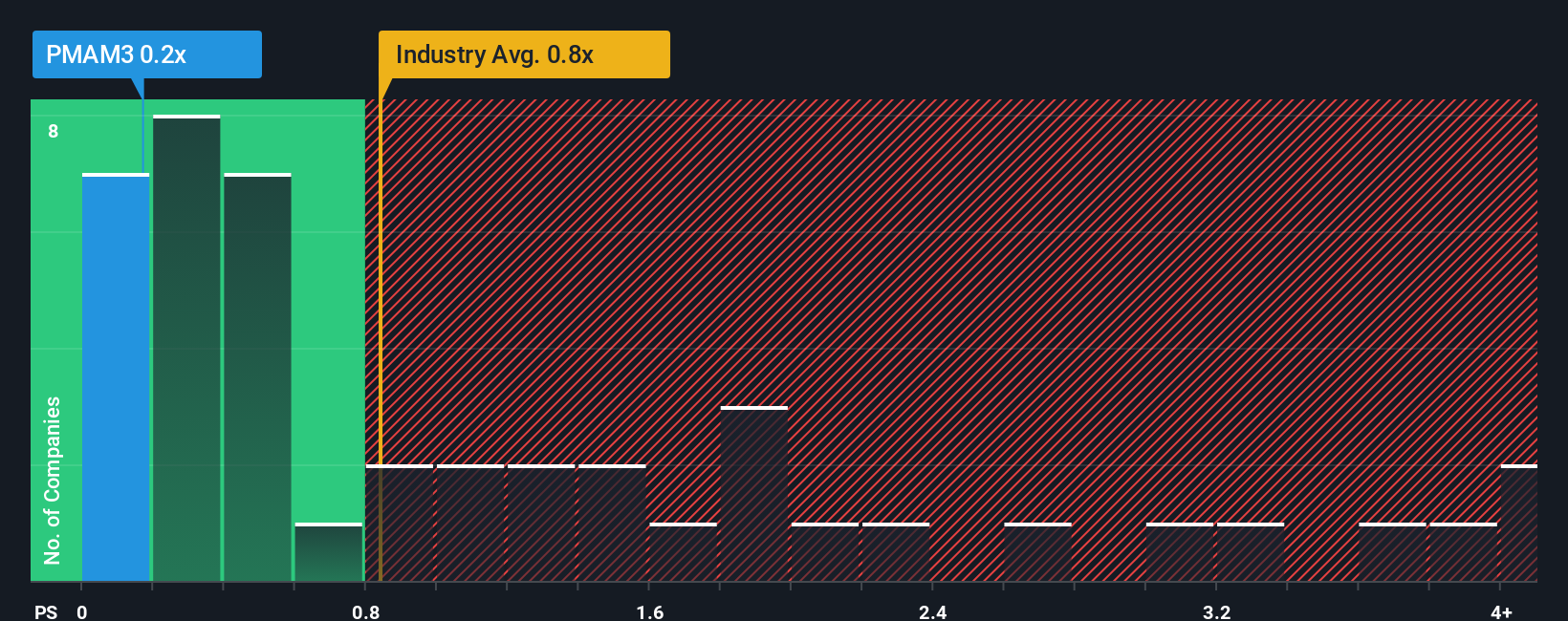

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Paranapanema's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Metals and Mining industry in Brazil is also close to 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Paranapanema

How Paranapanema Has Been Performing

Revenue has risen firmly for Paranapanema recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Paranapanema will help you shine a light on its historical performance.How Is Paranapanema's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Paranapanema's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 85% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 0.4% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange that Paranapanema is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Paranapanema looks to be in line with the rest of the Metals and Mining industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Paranapanema currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the moderate P/S lower. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Paranapanema (of which 3 are a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on Paranapanema, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PMAM3

Paranapanema

Produces and sells copper and its byproducts in Brazil and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion