- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CBAV3

Not Many Are Piling Into Companhia Brasileira de Alumínio (BVMF:CBAV3) Just Yet

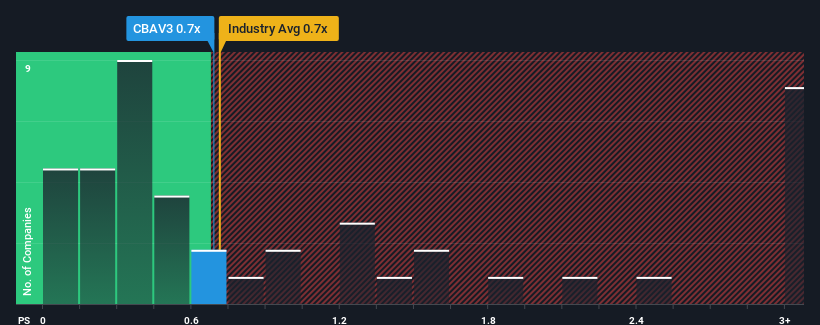

It's not a stretch to say that Companhia Brasileira de Alumínio's (BVMF:CBAV3) price-to-sales (or "P/S") ratio of 0.7x seems quite "middle-of-the-road" for Metals and Mining companies in Brazil, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Companhia Brasileira de Alumínio

What Does Companhia Brasileira de Alumínio's Recent Performance Look Like?

Recent times haven't been great for Companhia Brasileira de Alumínio as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Companhia Brasileira de Alumínio's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Companhia Brasileira de Alumínio's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.7% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.0% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Companhia Brasileira de Alumínio's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Companhia Brasileira de Alumínio's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Companhia Brasileira de Alumínio's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Companhia Brasileira de Alumínio (at least 2 which can't be ignored), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:CBAV3

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives