- Brazil

- /

- Personal Products

- /

- BOVESPA:NTCO3

Natura &Co Holding S.A.'s (BVMF:NTCO3) Shares Lagging The Industry But So Is The Business

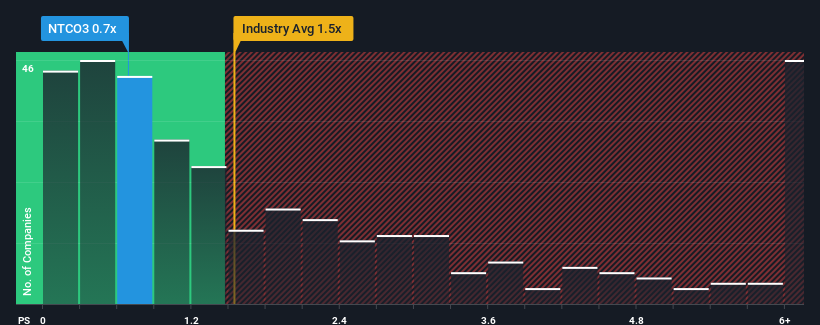

Natura &Co Holding S.A.'s (BVMF:NTCO3) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Personal Products industry in Brazil, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Natura &Co Holding

How Has Natura &Co Holding Performed Recently?

With revenue growth that's superior to most other companies of late, Natura &Co Holding has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Natura &Co Holding will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Natura &Co Holding's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 39% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 31% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue growth is heading into negative territory, declining 0.4% over the next year. Meanwhile, the broader industry is forecast to expand by 5.5%, which paints a poor picture.

With this in consideration, we find it intriguing that Natura &Co Holding's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Natura &Co Holding's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Natura &Co Holding you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Natura &Co Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:NTCO3

Natura &Co Holding

Engages in the manufacturing, distribution, and sale of cosmetics, fragrances, and personal care products in Brazil, Asia, Europe, North America, South America, the Middle East, Africa, and Oceania.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives