- Brazil

- /

- Healthcare Services

- /

- BOVESPA:RDOR3

Shareholders in Rede D'Or São Luiz (BVMF:RDOR3) are in the red if they invested a year ago

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Rede D'Or São Luiz S.A. (BVMF:RDOR3) have tasted that bitter downside in the last year, as the share price dropped 36%. That falls noticeably short of the market decline of around 5.2%. Rede D'Or São Luiz hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Rede D'Or São Luiz

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Rede D'Or São Luiz reported an EPS drop of 34% for the last year. We note that the 36% share price drop is very close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price has approximately tracked EPS growth.

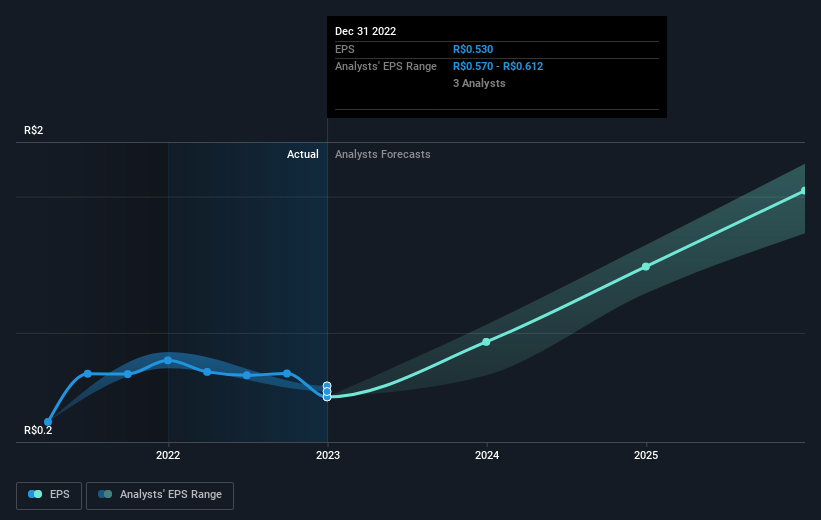

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Rede D'Or São Luiz's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Rede D'Or São Luiz shareholders are happy with the loss of 36% over twelve months (even including dividends). That falls short of the market, which lost 5.2%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 28% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Rede D'Or São Luiz (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

But note: Rede D'Or São Luiz may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RDOR3

Undervalued with solid track record.

Market Insights

Community Narratives