- Brazil

- /

- Healthcare Services

- /

- BOVESPA:KRSA3

Kora Saúde Participações (BVMF:KRSA3) adds R$85m to market cap in the past 7 days, though investors from a year ago are still down 65%

It's nice to see the Kora Saúde Participações S.A. (BVMF:KRSA3) share price up 11% in a week. But that's not enough to compensate for the decline over the last twelve months. Specifically, the stock price slipped by 65% in that time. So the bounce should be viewed in that context. You could argue that the sell-off was too severe.

While the last year has been tough for Kora Saúde Participações shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Kora Saúde Participações

SWOT Analysis for Kora Saúde Participações

- No major strengths identified for KRSA3.

- Interest payments on debt are not well covered.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

Kora Saúde Participações isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

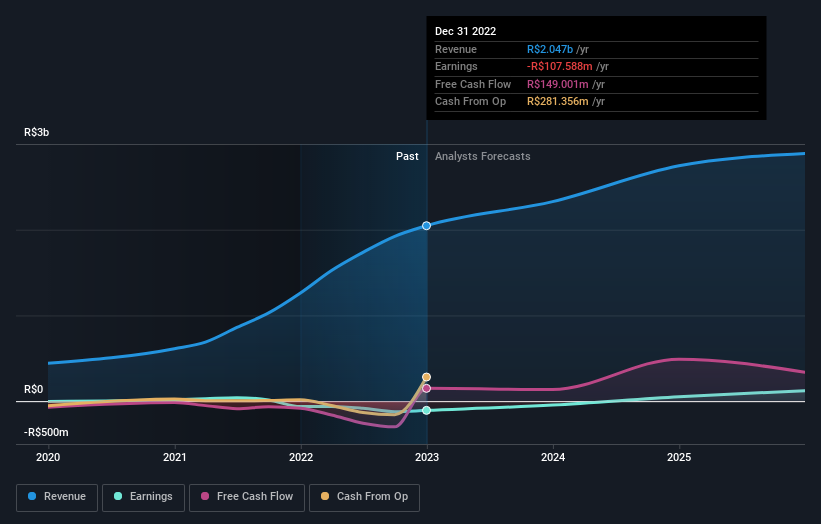

In the last year Kora Saúde Participações saw its revenue grow by 62%. That's a strong result which is better than most other loss making companies. Meanwhile, the share price slid 65%. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Kora Saúde Participações' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kora Saúde Participações shareholders are down 65% for the year, even worse than the market loss of 5.2%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 8.4%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Kora Saúde Participações has 1 warning sign we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kora Saúde Participações might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:KRSA3

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives