- Brazil

- /

- Healthcare Services

- /

- BOVESPA:HAPV3

Introducing Hapvida Participações e Investimentos (BVMF:HAPV3), A Stock That Climbed 55% In The Last Year

It might be of some concern to shareholders to see the Hapvida Participações e Investimentos S.A. (BVMF:HAPV3) share price down 15% in the last month. But that doesn't change the reality that over twelve months the stock has done really well. After all, the share price is up a market-beating 55% in that time.

View our latest analysis for Hapvida Participações e Investimentos

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Hapvida Participações e Investimentos actually saw its earnings per share drop 4.4%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

However the year on year revenue growth of 54% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

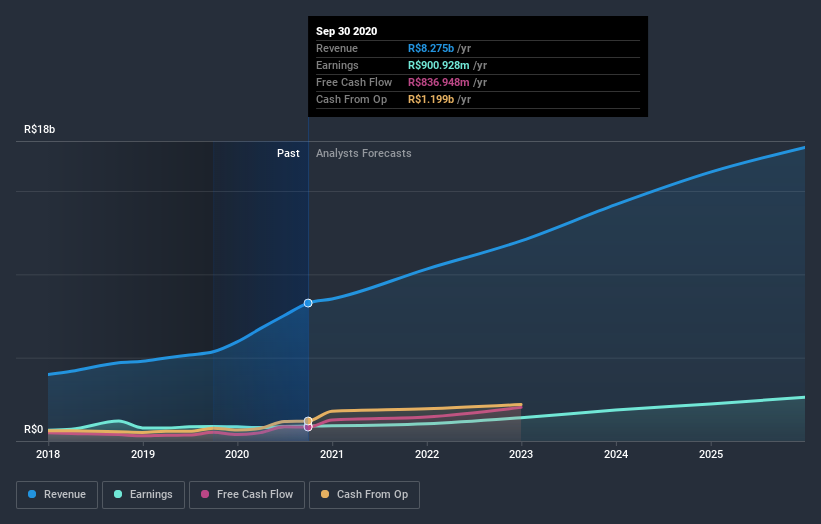

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Hapvida Participações e Investimentos is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Hapvida Participações e Investimentos stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Hapvida Participações e Investimentos boasts a total shareholder return of 56% for the last year. That's better than the more recent three month gain of 0.3%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Hapvida Participações e Investimentos .

We will like Hapvida Participações e Investimentos better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

When trading Hapvida Participações e Investimentos or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hapvida Participações e Investimentos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:HAPV3

Hapvida Participações e Investimentos

Operates in the health sector in Brazil.

Good value with adequate balance sheet.

Market Insights

Community Narratives