- Brazil

- /

- Specialty Stores

- /

- BOVESPA:UGPA3

Subdued Growth No Barrier To Ultrapar Participações S.A.'s (BVMF:UGPA3) Price

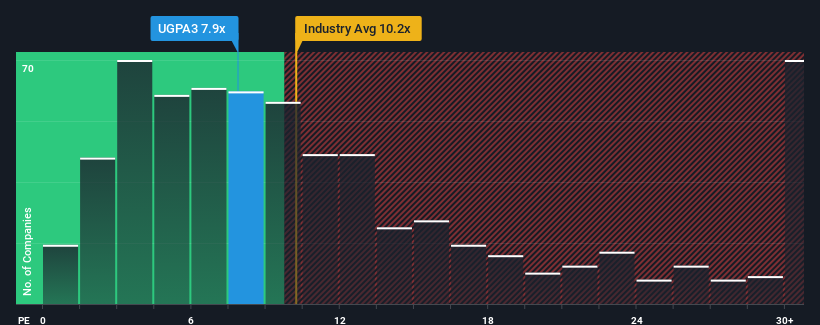

With a median price-to-earnings (or "P/E") ratio of close to 9x in Brazil, you could be forgiven for feeling indifferent about Ultrapar Participações S.A.'s (BVMF:UGPA3) P/E ratio of 7.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Ultrapar Participações certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Ultrapar Participações

Is There Some Growth For Ultrapar Participações?

In order to justify its P/E ratio, Ultrapar Participações would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 91% last year. The latest three year period has also seen an excellent 300% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 3.6% per annum during the coming three years according to the twelve analysts following the company. That's not great when the rest of the market is expected to grow by 15% per annum.

In light of this, it's somewhat alarming that Ultrapar Participações' P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Ultrapar Participações' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 3 warning signs for Ultrapar Participações (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on Ultrapar Participações, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:UGPA3

Ultrapar Participações

Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives