- Brazil

- /

- Oil and Gas

- /

- BOVESPA:BRAV3

3R Petroleum Óleo e Gás S.A.'s (BVMF:RRRP3) P/E Is Still On The Mark Following 29% Share Price Bounce

The 3R Petroleum Óleo e Gás S.A. (BVMF:RRRP3) share price has done very well over the last month, posting an excellent gain of 29%. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

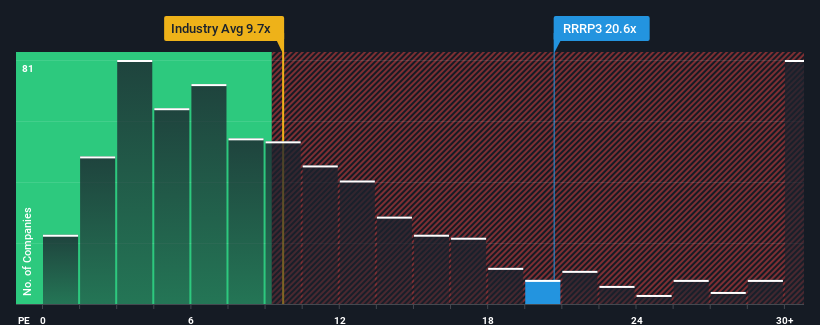

After such a large jump in price, 3R Petroleum Óleo e Gás' price-to-earnings (or "P/E") ratio of 20.6x might make it look like a strong sell right now compared to the market in Brazil, where around half of the companies have P/E ratios below 10x and even P/E's below 7x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

3R Petroleum Óleo e Gás certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for 3R Petroleum Óleo e Gás

How Is 3R Petroleum Óleo e Gás' Growth Trending?

3R Petroleum Óleo e Gás' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 145% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 100% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 16% per year, which is noticeably less attractive.

In light of this, it's understandable that 3R Petroleum Óleo e Gás' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On 3R Petroleum Óleo e Gás' P/E

3R Petroleum Óleo e Gás' P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of 3R Petroleum Óleo e Gás' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for 3R Petroleum Óleo e Gás (2 are significant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Brava Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BRAV3

Brava Energia

Engages in the exploration and production of oil and natural gas in Brazil.

High growth potential and fair value.

Market Insights

Community Narratives