- Brazil

- /

- Oil and Gas

- /

- BOVESPA:BRAV3

Further Upside For Brava Energia S.A. (BVMF:BRAV3) Shares Could Introduce Price Risks After 27% Bounce

Brava Energia S.A. (BVMF:BRAV3) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

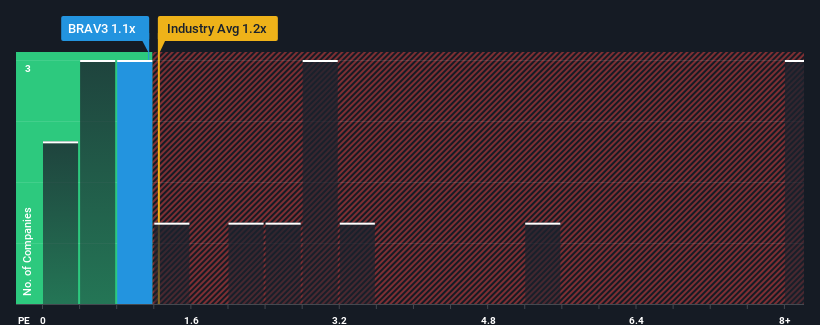

Even after such a large jump in price, there still wouldn't be many who think Brava Energia's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in Brazil's Oil and Gas industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Brava Energia

What Does Brava Energia's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Brava Energia has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Brava Energia.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Brava Energia would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 105%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 25% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be materially higher than the 3.7% per year growth forecast for the broader industry.

In light of this, it's curious that Brava Energia's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Brava Energia's P/S

Brava Energia's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Brava Energia's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Brava Energia (2 are a bit unpleasant) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Brava Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BRAV3

Brava Energia

Engages in the exploration and production of oil and natural gas in Brazil.

Good value with moderate growth potential.

Market Insights

Community Narratives