- Brazil

- /

- Consumer Services

- /

- BOVESPA:YDUQ3

Yduqs Participações (BVMF:YDUQ3) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Yduqs Participações S.A. (BVMF:YDUQ3) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Yduqs Participações

What Is Yduqs Participações's Net Debt?

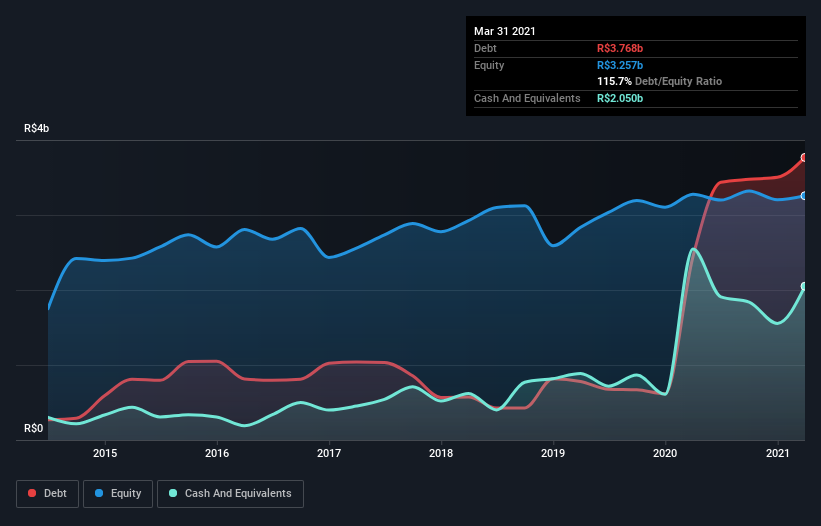

The image below, which you can click on for greater detail, shows that at March 2021 Yduqs Participações had debt of R$3.77b, up from R$2.44b in one year. However, it also had R$2.05b in cash, and so its net debt is R$1.72b.

How Healthy Is Yduqs Participações' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Yduqs Participações had liabilities of R$1.22b due within 12 months and liabilities of R$5.17b due beyond that. Offsetting this, it had R$2.05b in cash and R$949.4m in receivables that were due within 12 months. So it has liabilities totalling R$3.39b more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Yduqs Participações has a market capitalization of R$10.7b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Even though Yduqs Participações's debt is only 1.5, its interest cover is really very low at 2.2. This does suggest the company is paying fairly high interest rates. Either way there's no doubt the stock is using meaningful leverage. Importantly, Yduqs Participações's EBIT fell a jaw-dropping 24% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Yduqs Participações can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Yduqs Participações produced sturdy free cash flow equating to 76% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Both Yduqs Participações's EBIT growth rate and its interest cover were discouraging. But at least its conversion of EBIT to free cash flow is a gleaming silver lining to those clouds. Looking at all the angles mentioned above, it does seem to us that Yduqs Participações is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Yduqs Participações you should be aware of, and 1 of them can't be ignored.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:YDUQ3

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives