- Brazil

- /

- Hospitality

- /

- BOVESPA:CVCB3

Reflecting on CVC Brasil Operadora e Agência de Viagens' (BVMF:CVCB3) Share Price Returns Over The Last Year

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held CVC Brasil Operadora e Agência de Viagens S.A. (BVMF:CVCB3) over the last year knows what a loser feels like. The share price is down a hefty 64% in that time. We note that it has not been easy for shareholders over three years, either; the share price is down 52% in that time.

View our latest analysis for CVC Brasil Operadora e Agência de Viagens

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

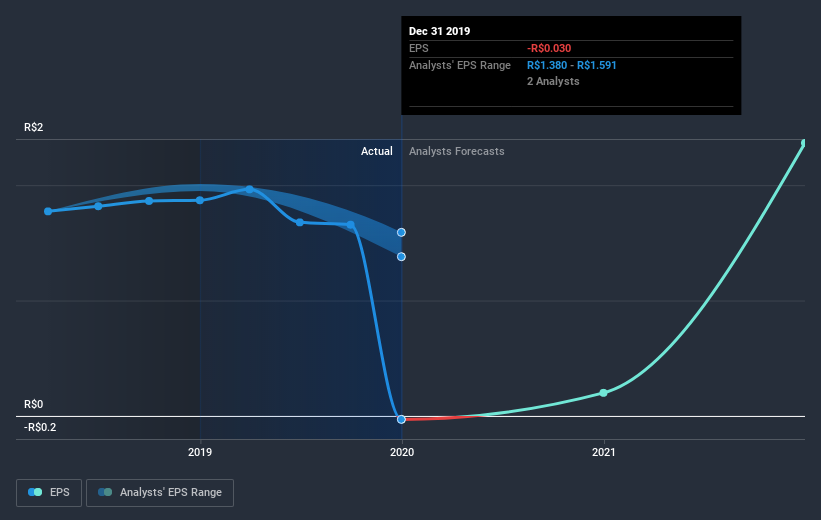

During the last year CVC Brasil Operadora e Agência de Viagens saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on CVC Brasil Operadora e Agência de Viagens' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between CVC Brasil Operadora e Agência de Viagens' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. CVC Brasil Operadora e Agência de Viagens hasn't been paying dividends, but its TSR of -62% exceeds its share price return of -64%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

CVC Brasil Operadora e Agência de Viagens shareholders are down 62% for the year, but the market itself is up 3.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 5.3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand CVC Brasil Operadora e Agência de Viagens better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with CVC Brasil Operadora e Agência de Viagens (including 1 which is doesn't sit too well with us) .

We will like CVC Brasil Operadora e Agência de Viagens better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade CVC Brasil Operadora e Agência de Viagens, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens

Provides tourism services in Brazil and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives