- Brazil

- /

- Hospitality

- /

- BOVESPA:CVCB3

Is CVC Brasil Operadora e Agência de Viagens (BVMF:CVCB3) Using Too Much Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CVC Brasil Operadora e Agência de Viagens S.A. (BVMF:CVCB3) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CVC Brasil Operadora e Agência de Viagens

What Is CVC Brasil Operadora e Agência de Viagens's Debt?

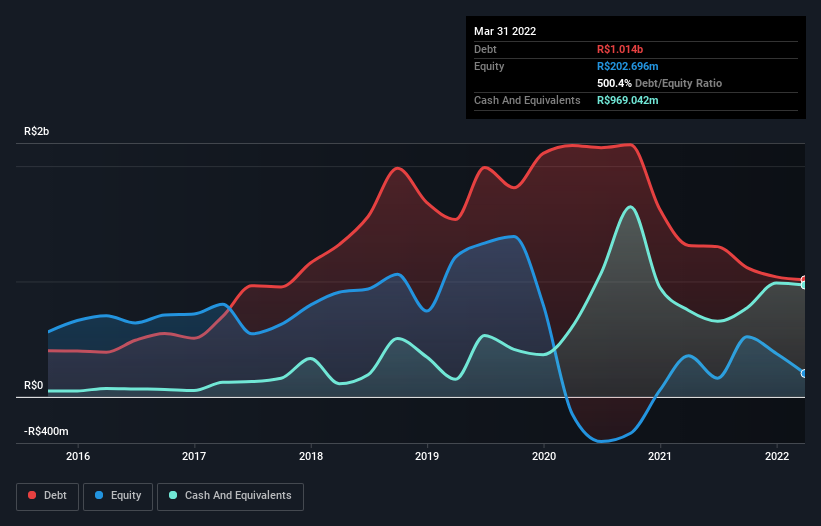

As you can see below, CVC Brasil Operadora e Agência de Viagens had R$1.01b of debt at March 2022, down from R$1.31b a year prior. On the flip side, it has R$969.0m in cash leading to net debt of about R$45.3m.

How Healthy Is CVC Brasil Operadora e Agência de Viagens' Balance Sheet?

We can see from the most recent balance sheet that CVC Brasil Operadora e Agência de Viagens had liabilities of R$3.06b falling due within a year, and liabilities of R$1.21b due beyond that. On the other hand, it had cash of R$969.0m and R$988.0m worth of receivables due within a year. So it has liabilities totalling R$2.32b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of R$1.79b, we think shareholders really should watch CVC Brasil Operadora e Agência de Viagens's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if CVC Brasil Operadora e Agência de Viagens can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year CVC Brasil Operadora e Agência de Viagens wasn't profitable at an EBIT level, but managed to grow its revenue by 142%, to R$953m. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

Even though CVC Brasil Operadora e Agência de Viagens managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Indeed, it lost a very considerable R$352m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of R$17m over the last twelve months. That means it's on the risky side of things. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with CVC Brasil Operadora e Agência de Viagens (at least 1 which is concerning) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CVCB3

CVC Brasil Operadora e Agência de Viagens

Provides tourism services in Brazil and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives