- Brazil

- /

- Consumer Services

- /

- BOVESPA:CSED3

Market Participants Recognise Cruzeiro do Sul Educacional S.A.'s (BVMF:CSED3) Revenues

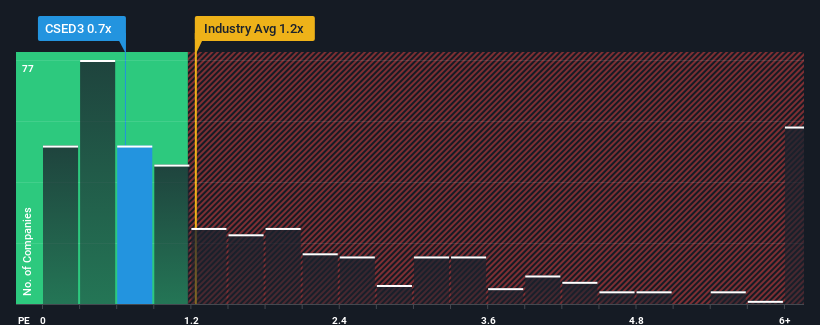

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Consumer Services industry in Brazil, you could be forgiven for feeling indifferent about Cruzeiro do Sul Educacional S.A.'s (BVMF:CSED3) P/S ratio of 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Cruzeiro do Sul Educacional

How Has Cruzeiro do Sul Educacional Performed Recently?

Cruzeiro do Sul Educacional's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on Cruzeiro do Sul Educacional will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cruzeiro do Sul Educacional.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Cruzeiro do Sul Educacional's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 9.3% over the next year. That's shaping up to be similar to the 9.0% growth forecast for the broader industry.

In light of this, it's understandable that Cruzeiro do Sul Educacional's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Cruzeiro do Sul Educacional maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cruzeiro do Sul Educacional you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSED3

Undervalued with solid track record.

Market Insights

Community Narratives