- Brazil

- /

- Consumer Services

- /

- BOVESPA:CSED3

Cruzeiro do Sul Educacional S.A. (BVMF:CSED3) Stocks Shoot Up 27% But Its P/E Still Looks Reasonable

Cruzeiro do Sul Educacional S.A. (BVMF:CSED3) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 67% share price drop in the last twelve months.

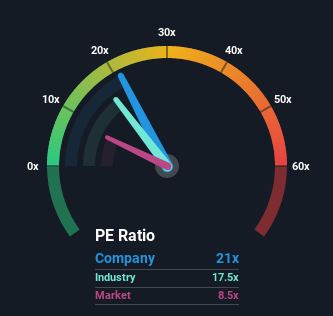

Following the firm bounce in price, given close to half the companies in Brazil have price-to-earnings ratios (or "P/E's") below 8x, you may consider Cruzeiro do Sul Educacional as a stock to avoid entirely with its 21x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Cruzeiro do Sul Educacional certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Cruzeiro do Sul Educacional

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Cruzeiro do Sul Educacional would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 280% last year. Still, incredibly EPS has fallen 52% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 49% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 14% per year growth forecast for the broader market.

In light of this, it's understandable that Cruzeiro do Sul Educacional's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Cruzeiro do Sul Educacional's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Cruzeiro do Sul Educacional maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cruzeiro do Sul Educacional you should be aware of.

If these risks are making you reconsider your opinion on Cruzeiro do Sul Educacional, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSED3

Good value with reasonable growth potential.

Market Insights

Community Narratives