- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

Do Raia Drogasil's (BVMF:RADL3) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Raia Drogasil (BVMF:RADL3), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Raia Drogasil

Raia Drogasil's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Raia Drogasil managed to grow EPS by 12% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

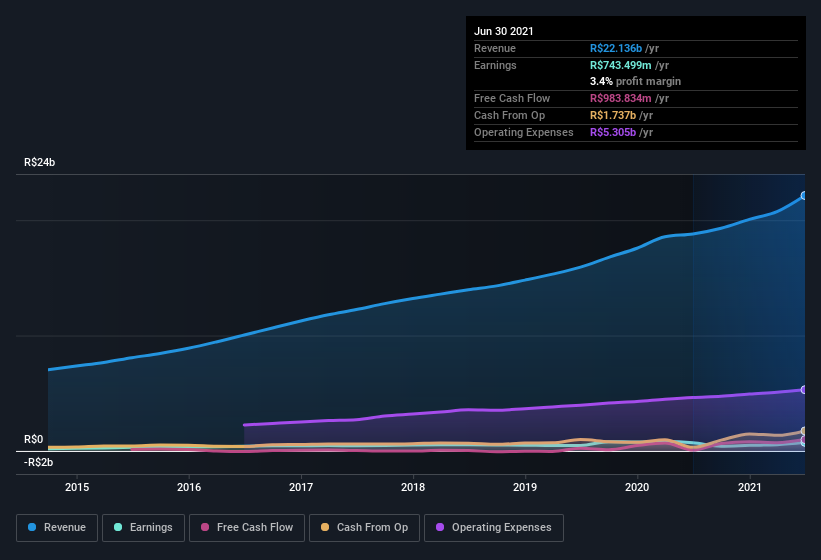

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Raia Drogasil maintained stable EBIT margins over the last year, all while growing revenue 18% to R$22b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Raia Drogasil's forecast profits?

Are Raia Drogasil Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a R$43b company like Raia Drogasil. But we do take comfort from the fact that they are investors in the company. Notably, they have an enormous stake in the company, worth R$7.7b. Coming in at 18% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Should You Add Raia Drogasil To Your Watchlist?

As I already mentioned, Raia Drogasil is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Raia Drogasil shapes up to industry peers, when it comes to ROE.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumery, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives