- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PGMN3

Empreendimentos Pague Menos S.A.'s (BVMF:PGMN3) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Empreendimentos Pague Menos' (BVMF:PGMN3) stock is up by a considerable 59% over the past month. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimately dictates market outcomes. In this article, we decided to focus on Empreendimentos Pague Menos' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Empreendimentos Pague Menos is:

6.9% = R$198m ÷ R$2.9b (Based on the trailing twelve months to September 2025).

The 'return' is the yearly profit. That means that for every R$1 worth of shareholders' equity, the company generated R$0.07 in profit.

View our latest analysis for Empreendimentos Pague Menos

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Empreendimentos Pague Menos' Earnings Growth And 6.9% ROE

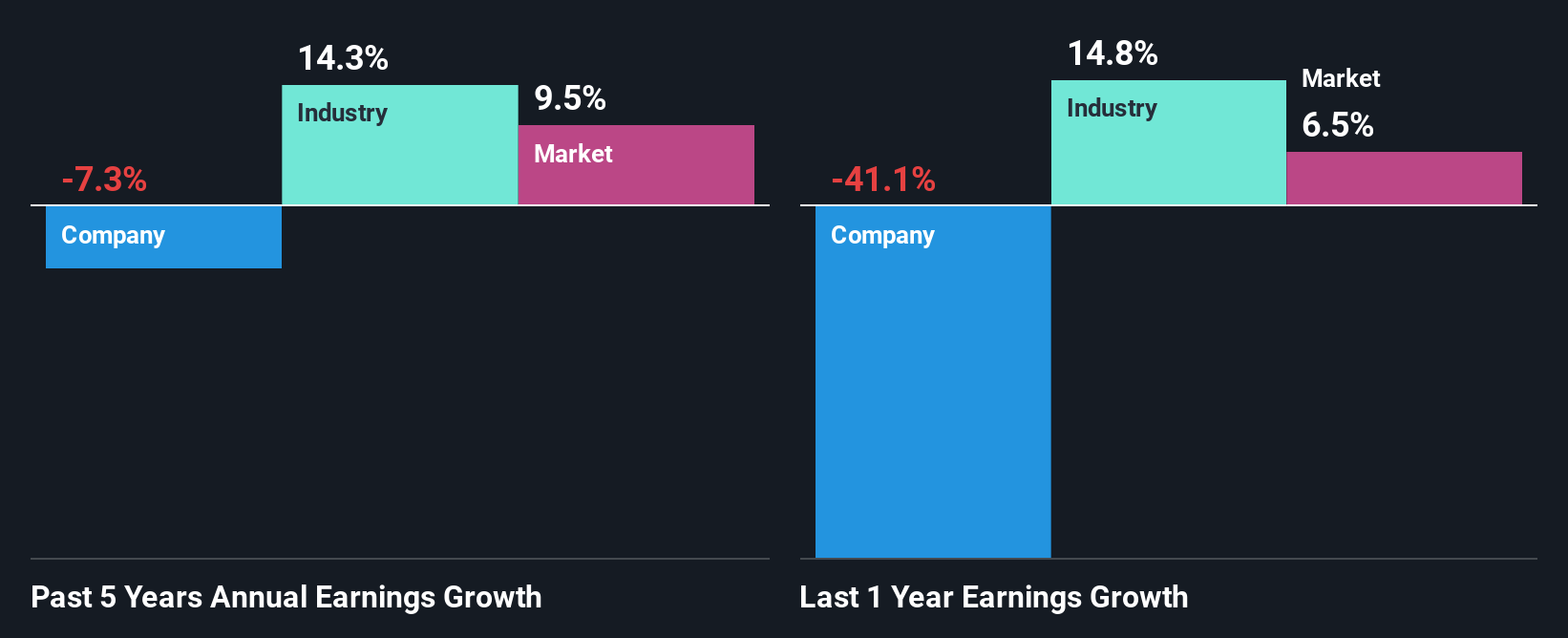

As you can see, Empreendimentos Pague Menos' ROE looks pretty weak. Even when compared to the industry average of 12%, the ROE figure is pretty disappointing. Given the circumstances, the significant decline in net income by 7.3% seen by Empreendimentos Pague Menos over the last five years is not surprising. We reckon that there could also be other factors at play here. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared Empreendimentos Pague Menos' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 14% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is PGMN3 fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Empreendimentos Pague Menos Making Efficient Use Of Its Profits?

Empreendimentos Pague Menos' high three-year median payout ratio of 162% suggests that the company is depleting its resources to keep up its dividend payments, and this shows in its shrinking earnings. Paying a dividend higher than reported profits is not a sustainable move. To know the 3 risks we have identified for Empreendimentos Pague Menos visit our risks dashboard for free.

Additionally, Empreendimentos Pague Menos has paid dividends over a period of three years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 26% over the next three years. As a result, the expected drop in Empreendimentos Pague Menos' payout ratio explains the anticipated rise in the company's future ROE to 11%, over the same period.

Conclusion

Overall, we would be extremely cautious before making any decision on Empreendimentos Pague Menos. Specifically, it has shown quite an unsatisfactory performance as far as earnings growth is concerned, and a poor ROE and an equally poor rate of reinvestment seem to be the reason behind this inadequate performance. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Empreendimentos Pague Menos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PGMN3

Empreendimentos Pague Menos

Engages in the retail sale of medicines, perfumes, personal hygiene and beauty products in Brazil.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026