- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PCAR3

Strong week for Companhia Brasileira De Distribuicao (BVMF:PCAR3) shareholders doesn't alleviate pain of five-year loss

This week we saw the Companhia Brasileira De Distribuicao (BVMF:PCAR3) share price climb by 12%. But over the last half decade, the stock has not performed well. After all, the share price is down 97% in that time, significantly under-performing the market. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Companhia Brasileira De Distribuicao

Companhia Brasileira De Distribuicao isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Companhia Brasileira De Distribuicao reduced its trailing twelve month revenue by 22% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 14% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

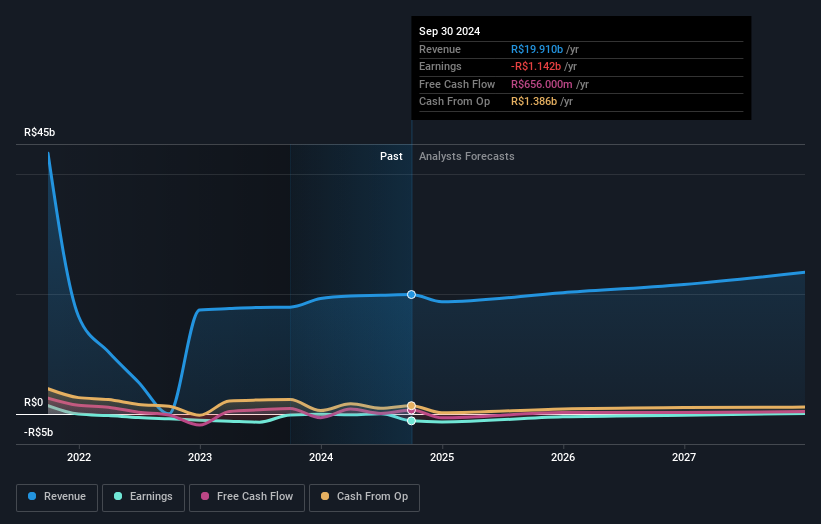

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Companhia Brasileira De Distribuicao's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Companhia Brasileira De Distribuicao's TSR, which was a 6.6% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 1.2% in the twelve months, Companhia Brasileira De Distribuicao shareholders did even worse, losing 25%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Companhia Brasileira De Distribuicao has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

Of course Companhia Brasileira De Distribuicao may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PCAR3

Companhia Brasileira De Distribuicao

Engages in the operation of supermarkets, specialized stores, and department stores in Brazil.

Undervalued with moderate growth potential.

Market Insights

Community Narratives