- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PCAR3

Despite currently being unprofitable, Companhia Brasileira De Distribuicao (BVMF:PCAR3) has delivered a 37% return to shareholders over 3 years

One of the frustrations of investing is when a stock goes down. But when the market is down, you're bound to have some losers. While the Companhia Brasileira De Distribuicao (BVMF:PCAR3) share price is down 95% in the last three years, the total return to shareholders (which includes dividends) was 37%. And that total return actually beats the market decline of 4.8%. And the ride hasn't got any smoother in recent times over the last year, with the price 80% lower in that time. On top of that, the share price is down 19% in the last week. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 19% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Companhia Brasileira De Distribuicao

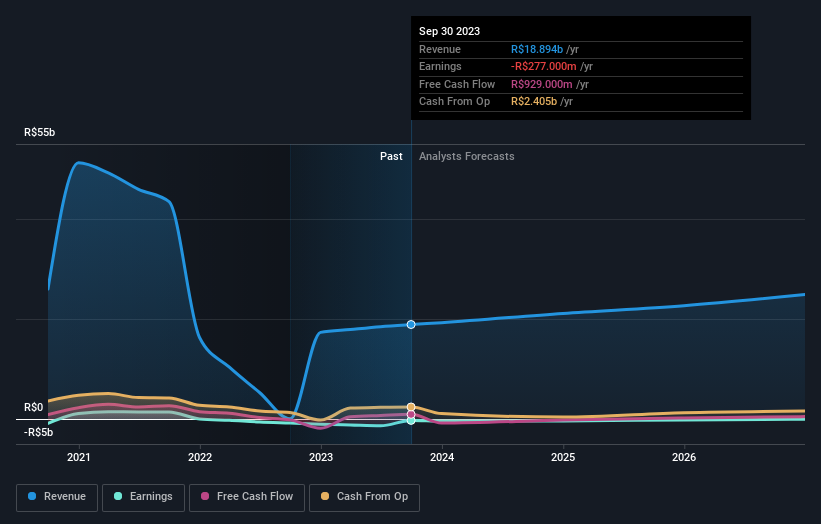

Because Companhia Brasileira De Distribuicao made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Companhia Brasileira De Distribuicao saw its revenue shrink by 46% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 25% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Companhia Brasileira De Distribuicao's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered Companhia Brasileira De Distribuicao's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Companhia Brasileira De Distribuicao's TSR of 37% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Over the last year, Companhia Brasileira De Distribuicao shareholders took a loss of 31%. In contrast the market gained about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 11% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Companhia Brasileira De Distribuicao (1 shouldn't be ignored!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PCAR3

Companhia Brasileira De Distribuicao

Engages in the operation of supermarkets, specialized stores, and department stores in Brazil.

Undervalued low.