Only Three Days Left To Cash In On Vivara Participações' (BVMF:VIVA3) Dividend

Vivara Participações S.A. (BVMF:VIVA3) is about to trade ex-dividend in the next 3 days. You will need to purchase shares before the 30th of December to receive the dividend, which will be paid on the 31st of December.

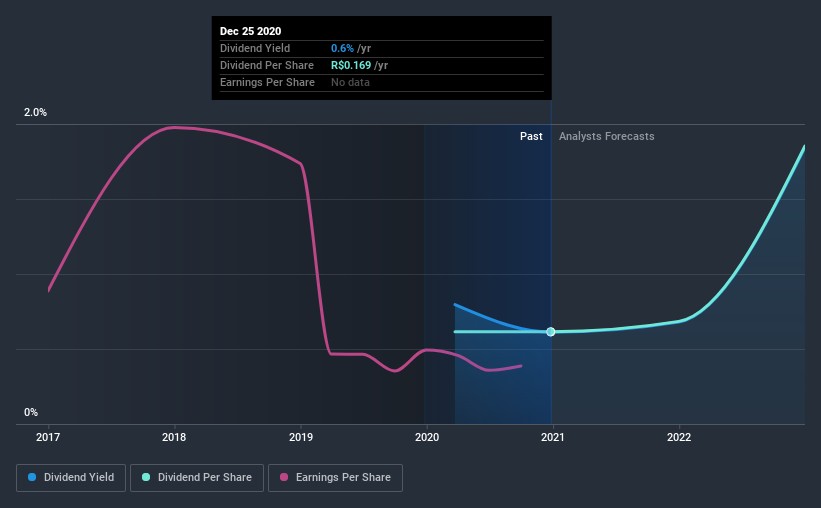

Vivara Participações's next dividend payment will be R$0.11 per share, on the back of last year when the company paid a total of R$0.17 to shareholders. Last year's total dividend payments show that Vivara Participações has a trailing yield of 0.6% on the current share price of R$27.65. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Vivara Participações can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Vivara Participações

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Vivara Participações has a low and conservative payout ratio of just 19% of its income after tax. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Luckily it paid out just 3.4% of its free cash flow last year.

It's positive to see that Vivara Participações's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Vivara Participações's 15% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Vivara Participações also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Given that Vivara Participações has only been paying a dividend for a year, there's not much of a past history to draw insight from.

To Sum It Up

Should investors buy Vivara Participações for the upcoming dividend? Vivara Participações has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. All things considered, we are not particularly enthused about Vivara Participações from a dividend perspective.

Ever wonder what the future holds for Vivara Participações? See what the three analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Vivara Participações, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:VIVA3

Vivara Participações

Engages in the manufacture and sale of jewelry and other articles in Latin America.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives