If You Had Bought Vivara Participações' (BVMF:VIVA3) Shares A Year Ago You Would Be Down 13%

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Vivara Participações S.A. (BVMF:VIVA3) shareholders over the last year, as the share price declined 13%. That falls noticeably short of the market return of around 5.9%. Because Vivara Participações hasn't been listed for many years, the market is still learning about how the business performs. And the share price decline continued over the last week, dropping some 8.2%.

View our latest analysis for Vivara Participações

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Vivara Participações share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Given the yield is quite low, at 0.6%, we doubt the dividend can shed much light on the share price. On the other hand, we're certainly perturbed by the 23% decline in Vivara Participações' revenue. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

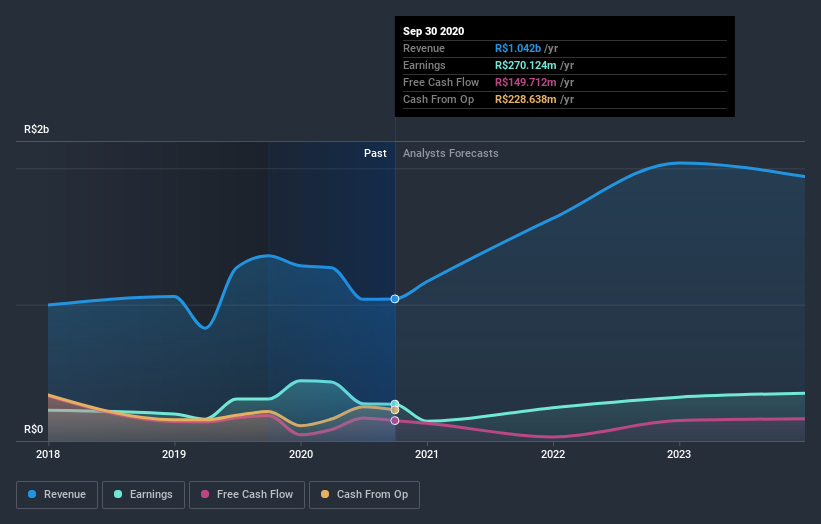

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Vivara Participações shareholders are down 13% for the year (even including dividends), the market itself is up 5.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 5.0%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. Is Vivara Participações cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you decide to trade Vivara Participações, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:VIVA3

Vivara Participações

Engages in the manufacture and sale of jewelry and other articles in Latin America.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives