- Brazil

- /

- Consumer Durables

- /

- BOVESPA:RDNI3

RNI Negócios Imobiliários S.A.'s (BVMF:RDNI3) Shares Climb 26% But Its Business Is Yet to Catch Up

RNI Negócios Imobiliários S.A. (BVMF:RDNI3) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

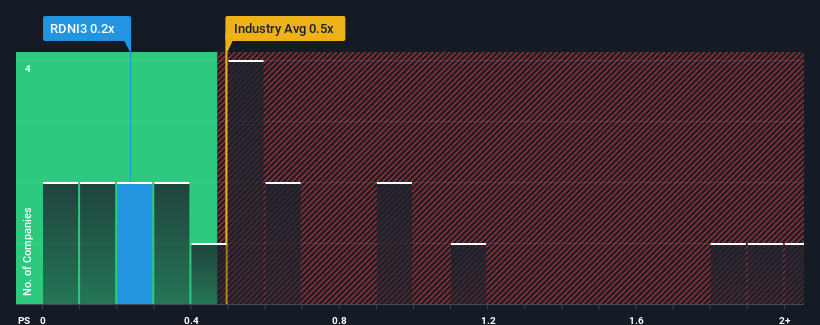

Although its price has surged higher, you could still be forgiven for feeling indifferent about RNI Negócios Imobiliários' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Brazil is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for RNI Negócios Imobiliários

How RNI Negócios Imobiliários Has Been Performing

Recent times have been quite advantageous for RNI Negócios Imobiliários as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on RNI Negócios Imobiliários will help you shine a light on its historical performance.How Is RNI Negócios Imobiliários' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like RNI Negócios Imobiliários' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 35% last year. As a result, it also grew revenue by 14% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 18% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that RNI Negócios Imobiliários' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now RNI Negócios Imobiliários' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of RNI Negócios Imobiliários revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about these 4 warning signs we've spotted with RNI Negócios Imobiliários (including 3 which are concerning).

If these risks are making you reconsider your opinion on RNI Negócios Imobiliários, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RDNI3

Slight and slightly overvalued.

Market Insights

Community Narratives