- Brazil

- /

- Consumer Durables

- /

- BOVESPA:MNDL3

More Unpleasant Surprises Could Be In Store For Mundial S.A. - Produtos de Consumo's (BVMF:MNDL3) Shares After Tumbling 29%

Mundial S.A. - Produtos de Consumo (BVMF:MNDL3) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

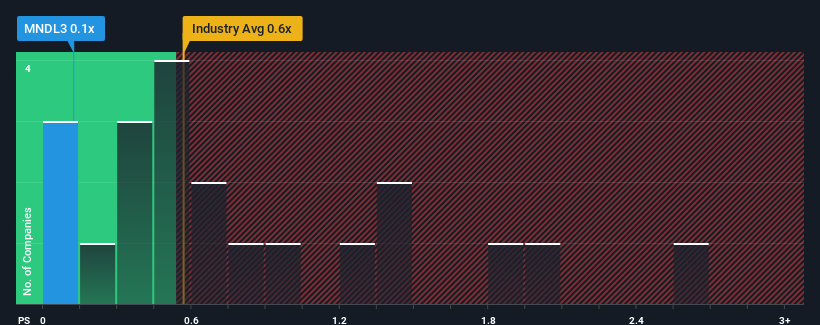

Even after such a large drop in price, it's still not a stretch to say that Mundial - Produtos de Consumo's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Brazil, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Mundial - Produtos de Consumo

What Does Mundial - Produtos de Consumo's Recent Performance Look Like?

Mundial - Produtos de Consumo has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Mundial - Produtos de Consumo will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Mundial - Produtos de Consumo?

Mundial - Produtos de Consumo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. The latest three year period has also seen an excellent 41% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Mundial - Produtos de Consumo's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Mundial - Produtos de Consumo's P/S?

With its share price dropping off a cliff, the P/S for Mundial - Produtos de Consumo looks to be in line with the rest of the Consumer Durables industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Mundial - Produtos de Consumo revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You should always think about risks. Case in point, we've spotted 3 warning signs for Mundial - Produtos de Consumo you should be aware of, and 2 of them are a bit concerning.

If these risks are making you reconsider your opinion on Mundial - Produtos de Consumo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MNDL3

Mundial - Produtos de Consumo

Manufactures and sells personal care products worldwide.

Slight with questionable track record.

Market Insights

Community Narratives