- Brazil

- /

- Consumer Durables

- /

- BOVESPA:EZTC3

Is EZTEC Empreendimentos e Participações (BVMF:EZTC3) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, EZTEC Empreendimentos e Participações S.A. (BVMF:EZTC3) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for EZTEC Empreendimentos e Participações

What Is EZTEC Empreendimentos e Participações's Debt?

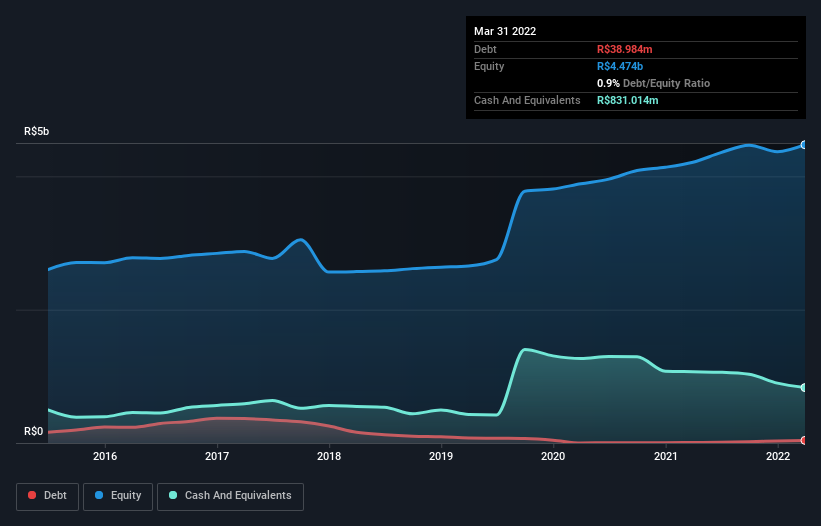

You can click the graphic below for the historical numbers, but it shows that as of March 2022 EZTEC Empreendimentos e Participações had R$39.0m of debt, an increase on R$8.24m, over one year. However, its balance sheet shows it holds R$831.0m in cash, so it actually has R$792.0m net cash.

How Strong Is EZTEC Empreendimentos e Participações' Balance Sheet?

According to the last reported balance sheet, EZTEC Empreendimentos e Participações had liabilities of R$360.1m due within 12 months, and liabilities of R$233.3m due beyond 12 months. Offsetting this, it had R$831.0m in cash and R$349.1m in receivables that were due within 12 months. So it actually has R$586.7m more liquid assets than total liabilities.

It's good to see that EZTEC Empreendimentos e Participações has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, EZTEC Empreendimentos e Participações boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that EZTEC Empreendimentos e Participações grew its EBIT by 19% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if EZTEC Empreendimentos e Participações can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. EZTEC Empreendimentos e Participações may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, EZTEC Empreendimentos e Participações basically broke even on a free cash flow basis. Some might say that's a concern, when it comes considering how easily it would be for it to down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that EZTEC Empreendimentos e Participações has net cash of R$792.0m, as well as more liquid assets than liabilities. And we liked the look of last year's 19% year-on-year EBIT growth. So we are not troubled with EZTEC Empreendimentos e Participações's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for EZTEC Empreendimentos e Participações that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if EZTEC Empreendimentos e Participações might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:EZTC3

EZTEC Empreendimentos e Participações

EZTEC Empreendimentos e Participações S.A.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026