- Brazil

- /

- Consumer Durables

- /

- BOVESPA:CYRE3

Shareholders of Cyrela Brazil Realty Empreendimentos e Participações (BVMF:CYRE3) Must Be Delighted With Their 351% Total Return

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Cyrela Brazil Realty S.A. Empreendimentos e Participações (BVMF:CYRE3) stock is up an impressive 272% over the last five years. It's also good to see the share price up 23% over the last quarter. But this could be related to the strong market, which is up 9.7% in the last three months.

Check out our latest analysis for Cyrela Brazil Realty Empreendimentos e Participações

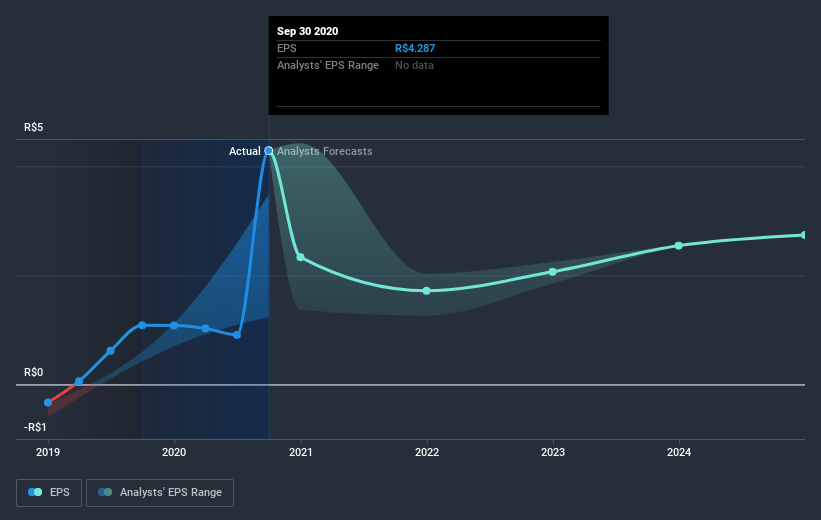

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Cyrela Brazil Realty Empreendimentos e Participações became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Cyrela Brazil Realty Empreendimentos e Participações has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Cyrela Brazil Realty Empreendimentos e Participações stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Cyrela Brazil Realty Empreendimentos e Participações, it has a TSR of 351% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Cyrela Brazil Realty Empreendimentos e Participações shareholders have received a total shareholder return of 7.1% over one year. Of course, that includes the dividend. However, that falls short of the 35% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. It's always interesting to track share price performance over the longer term. But to understand Cyrela Brazil Realty Empreendimentos e Participações better, we need to consider many other factors. Take risks, for example - Cyrela Brazil Realty Empreendimentos e Participações has 1 warning sign we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BR exchanges.

If you’re looking to trade Cyrela Brazil Realty Empreendimentos e Participações, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BOVESPA:CYRE3

Cyrela Brazil Realty Empreendimentos e Participações

Develops and constructs residential properties in Brazil.

Very undervalued with solid track record.