- Brazil

- /

- Commercial Services

- /

- BOVESPA:OPCT3

Unpleasant Surprises Could Be In Store For OceanPact Serviços Marítimos S.A.'s (BVMF:OPCT3) Shares

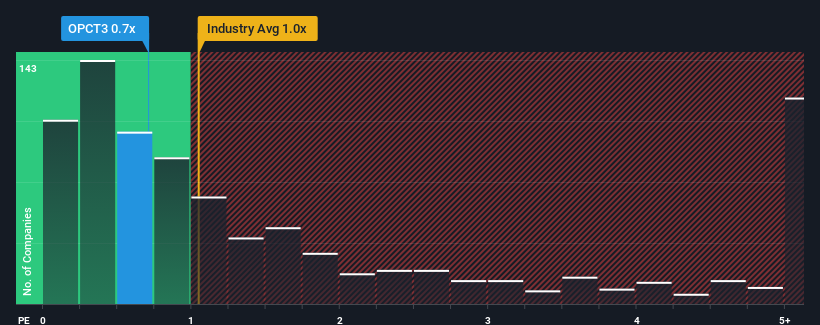

There wouldn't be many who think OceanPact Serviços Marítimos S.A.'s (BVMF:OPCT3) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Commercial Services industry in Brazil is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for OceanPact Serviços Marítimos

How OceanPact Serviços Marítimos Has Been Performing

With revenue growth that's superior to most other companies of late, OceanPact Serviços Marítimos has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think OceanPact Serviços Marítimos' future stacks up against the industry? In that case, our free report is a great place to start.How Is OceanPact Serviços Marítimos' Revenue Growth Trending?

In order to justify its P/S ratio, OceanPact Serviços Marítimos would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 36% gain to the company's top line. The latest three year period has also seen an excellent 142% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 5.9% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 17% per annum, which is noticeably more attractive.

In light of this, it's curious that OceanPact Serviços Marítimos' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On OceanPact Serviços Marítimos' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of OceanPact Serviços Marítimos' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for OceanPact Serviços Marítimos that you should be aware of.

If you're unsure about the strength of OceanPact Serviços Marítimos' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:OPCT3

OceanPact Serviços Marítimos

Provides services related to the study, protection, monitoring, and sustainable use of the sea, coastline, and marine resources in Brazil and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026