- Brazil

- /

- Commercial Services

- /

- BOVESPA:OPCT3

OceanPact Serviços Marítimos S.A. Just Missed Earnings - But Analysts Have Updated Their Models

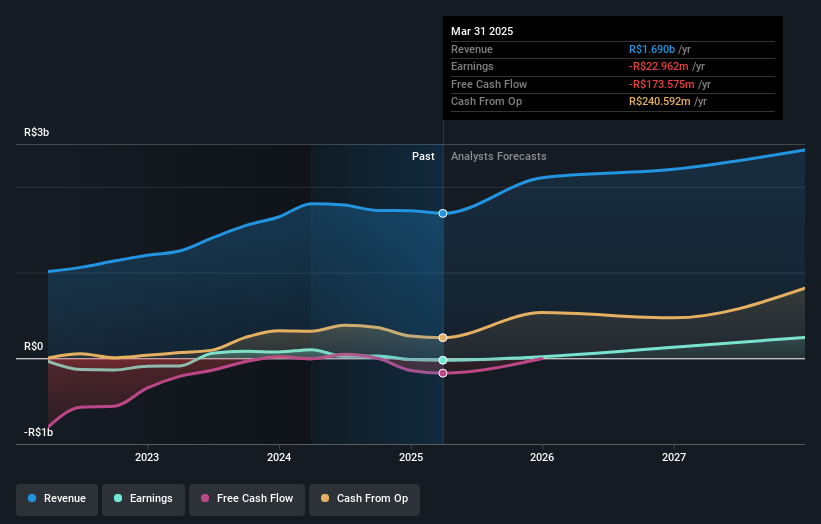

It's been a good week for OceanPact Serviços Marítimos S.A. (BVMF:OPCT3) shareholders, because the company has just released its latest first-quarter results, and the shares gained 2.3% to R$5.81. Statutory earnings per share fell badly short of expectations, coming in at R$0.069, some 28% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at R$459m. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Taking into account the latest results, the consensus forecast from OceanPact Serviços Marítimos' three analysts is for revenues of R$2.11b in 2025. This reflects a huge 25% improvement in revenue compared to the last 12 months. In the lead-up to this report, the analysts had been modelling revenues of R$1.81b and earnings per share (EPS) of R$0.096 in 2025. What's really interesting is that while the consensus made a nice gain to revenue estimates, it no longer provides an earnings per share estimate. What this implies is that after reporting of the latest results, the market believes revenue is more important.

See our latest analysis for OceanPact Serviços Marítimos

The average price target fell 7.8% to R$7.83, withthe analysts clearly having become less optimistic about OceanPact Serviços Marítimos'prospects following its latest earnings. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic OceanPact Serviços Marítimos analyst has a price target of R$8.00 per share, while the most pessimistic values it at R$7.50. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting OceanPact Serviços Marítimos' growth to accelerate, with the forecast 34% annualised growth to the end of 2025 ranking favourably alongside historical growth of 25% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 11% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that OceanPact Serviços Marítimos is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts upgraded their revenue estimates for next year. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

At least one of OceanPact Serviços Marítimos' three analysts has provided estimates out to 2027, which can be seen for free on our platform here.

You can also see whether OceanPact Serviços Marítimos is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:OPCT3

OceanPact Serviços Marítimos

Provides services related to the study, protection, monitoring, and sustainable use of the sea, coastline, and marine resources in Brazil and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success