- Brazil

- /

- Commercial Services

- /

- BOVESPA:AMBP3

Ambipar Participações e Empreendimentos S.A.'s (BVMF:AMBP3) P/E Is Still On The Mark Following 27% Share Price Bounce

Ambipar Participações e Empreendimentos S.A. (BVMF:AMBP3) shares have had a really impressive month, gaining 27% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

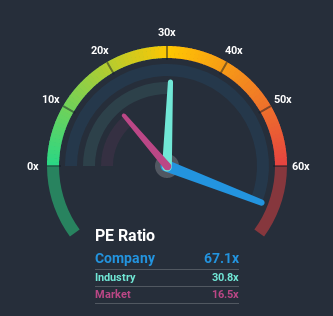

After such a large jump in price, Ambipar Participações e Empreendimentos may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 67.1x, since almost half of all companies in Brazil have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Ambipar Participações e Empreendimentos hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Ambipar Participações e Empreendimentos

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Ambipar Participações e Empreendimentos' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Even so, admirably EPS has lifted 449% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 152% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 32% growth forecast for the broader market.

With this information, we can see why Ambipar Participações e Empreendimentos is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Ambipar Participações e Empreendimentos have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Ambipar Participações e Empreendimentos' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Ambipar Participações e Empreendimentos with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Ambipar Participações e Empreendimentos' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade Ambipar Participações e Empreendimentos, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:AMBP3

Ambipar Participações e Empreendimentos

Ambipar Participações e Empreendimentos S.A.

Moderate growth potential with mediocre balance sheet.