Returns On Capital Are Showing Encouraging Signs At Kepler Weber (BVMF:KEPL3)

There are a few key trends to look for if we want to identify the next multi-bagger. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, Kepler Weber (BVMF:KEPL3) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Kepler Weber:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = R$119m ÷ (R$1.3b - R$581m) (Based on the trailing twelve months to September 2021).

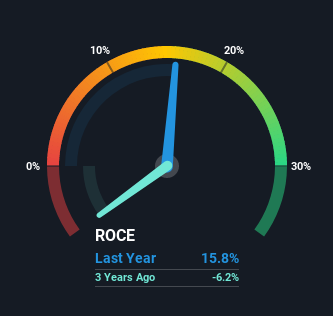

Therefore, Kepler Weber has an ROCE of 16%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Machinery industry average of 15%.

View our latest analysis for Kepler Weber

Historical performance is a great place to start when researching a stock so above you can see the gauge for Kepler Weber's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Kepler Weber, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

Kepler Weber has recently broken into profitability so their prior investments seem to be paying off. About five years ago the company was generating losses but things have turned around because it's now earning 16% on its capital. And unsurprisingly, like most companies trying to break into the black, Kepler Weber is utilizing 31% more capital than it was five years ago. We like this trend, because it tells us the company has profitable reinvestment opportunities available to it, and if it continues going forward that can lead to a multi-bagger performance.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 44% of its operations, which isn't ideal. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

The Bottom Line

To the delight of most shareholders, Kepler Weber has now broken into profitability. And a remarkable 172% total return over the last five years tells us that investors are expecting more good things to come in the future. Therefore, we think it would be worth your time to check if these trends are going to continue.

Like most companies, Kepler Weber does come with some risks, and we've found 3 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Kepler Weber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:KEPL3

Kepler Weber

Provides grain storage equipment and post-harvest grain solutions in Brazil, the Americas, Africa, Europe, and Asia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.