- Brazil

- /

- Electrical

- /

- BOVESPA:AERI3

Investors Don't See Light At End Of Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.'s (BVMF:AERI3) Tunnel And Push Stock Down 26%

Unfortunately for some shareholders, the Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A. (BVMF:AERI3) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

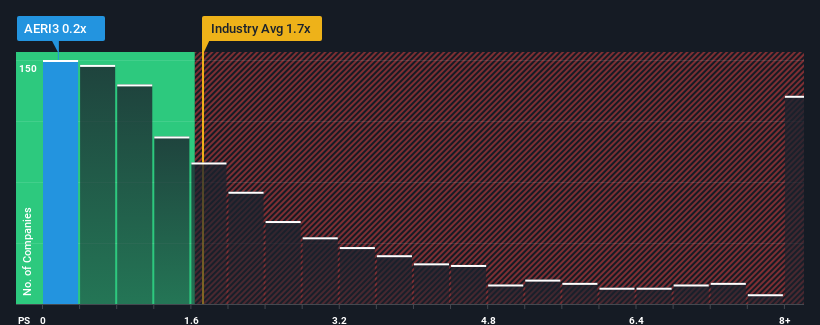

After such a large drop in price, Aeris Indústria e Comércio de Equipamentos para Geração de Energia may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Electrical industry in Brazil have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Aeris Indústria e Comércio de Equipamentos para Geração de Energia

What Does Aeris Indústria e Comércio de Equipamentos para Geração de Energia's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Aeris Indústria e Comércio de Equipamentos para Geração de Energia's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Aeris Indústria e Comércio de Equipamentos para Geração de Energia's future stacks up against the industry? In that case, our free report is a great place to start.How Is Aeris Indústria e Comércio de Equipamentos para Geração de Energia's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Aeris Indústria e Comércio de Equipamentos para Geração de Energia's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 38%. The last three years don't look nice either as the company has shrunk revenue by 24% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 0.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 20%, which is noticeably more attractive.

In light of this, it's understandable that Aeris Indústria e Comércio de Equipamentos para Geração de Energia's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Aeris Indústria e Comércio de Equipamentos para Geração de Energia's P/S

The southerly movements of Aeris Indústria e Comércio de Equipamentos para Geração de Energia's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aeris Indústria e Comércio de Equipamentos para Geração de Energia maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 4 warning signs for Aeris Indústria e Comércio de Equipamentos para Geração de Energia (2 are a bit unpleasant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:AERI3

Aeris Indústria e Comércio de Equipamentos para Geração de Energia

Aeris Indústria e Comércio de Equipamentos para Geração de Energia S.A.

Good value slight.