Stock Analysis

- Brazil

- /

- Auto Components

- /

- BOVESPA:FRAS3

Fras-le (BVMF:FRAS3) sheds 5.9% this week, as yearly returns fall more in line with earnings growth

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. For example, the Fras-le S.A. (BVMF:FRAS3) share price is up a whopping 311% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. On the other hand, the stock price has retraced 5.9% in the last week. However, this might be related to the overall market decline of 1.4% in a week.

In light of the stock dropping 5.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Fras-le

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

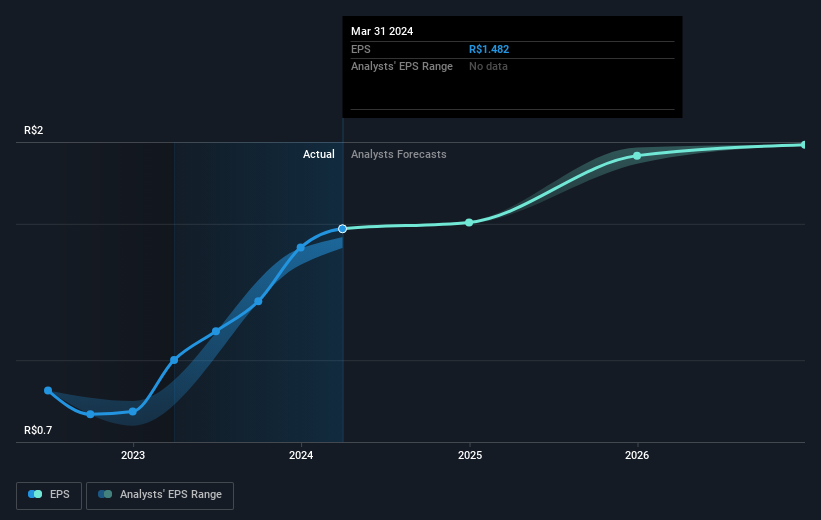

During five years of share price growth, Fras-le achieved compound earnings per share (EPS) growth of 47% per year. This EPS growth is higher than the 33% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Fras-le has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Fras-le's TSR for the last 5 years was 367%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Fras-le shareholders have received a total shareholder return of 50% over one year. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 36%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before forming an opinion on Fras-le you might want to consider these 3 valuation metrics.

We will like Fras-le better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:FRAS3

Fras-le

Provides friction materials for braking systems and other products in Brazil, England, Argentina, the United States, China, India, Uruguay, the Netherlands, and internationally.

Outstanding track record with excellent balance sheet.