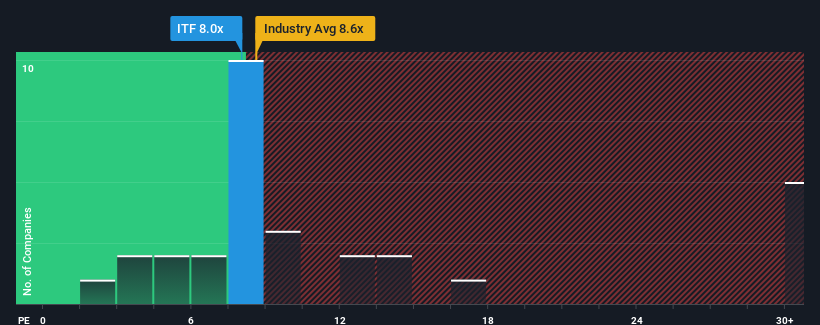

When close to half the companies in Bulgaria have price-to-earnings ratios (or "P/E's") above 13x, you may consider ITF Group AD (BUL:ITF) as an attractive investment with its 8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, ITF Group AD has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for ITF Group AD

How Is ITF Group AD's Growth Trending?

In order to justify its P/E ratio, ITF Group AD would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 76% last year. The strong recent performance means it was also able to grow EPS by 56% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 16% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that ITF Group AD is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that ITF Group AD currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Having said that, be aware ITF Group AD is showing 4 warning signs in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:ITF

ITF Group AD

ITF Group Ad, a non–bank financial institution, provides financial services to borrowers in Bulgaria.

Moderate risk with proven track record.

Market Insights

Community Narratives