Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Trace Group Hold PLC (BUL:T57) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Trace Group Hold

What Is Trace Group Hold's Net Debt?

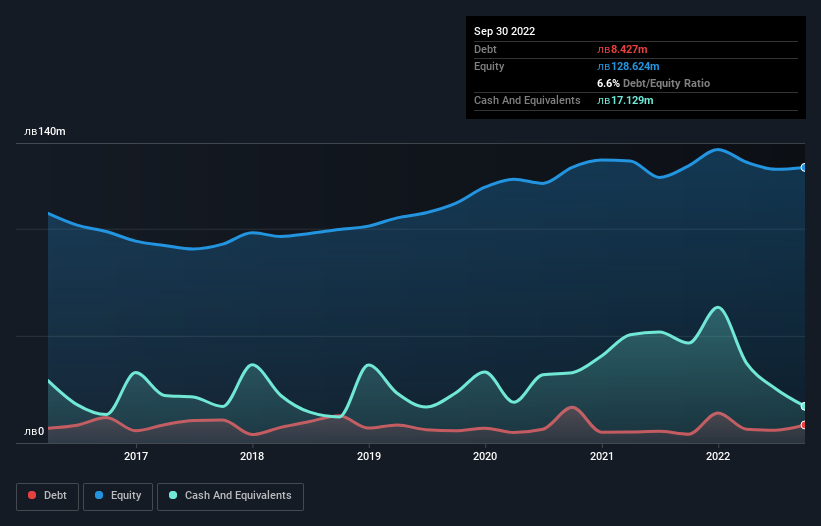

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Trace Group Hold had лв8.43m of debt, an increase on лв4.09m, over one year. But on the other hand it also has лв17.1m in cash, leading to a лв8.70m net cash position.

A Look At Trace Group Hold's Liabilities

Zooming in on the latest balance sheet data, we can see that Trace Group Hold had liabilities of лв97.2m due within 12 months and liabilities of лв15.4m due beyond that. On the other hand, it had cash of лв17.1m and лв95.8m worth of receivables due within a year. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Trace Group Hold's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the лв90.5m company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Trace Group Hold boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Trace Group Hold's load is not too heavy, because its EBIT was down 26% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Trace Group Hold's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Trace Group Hold has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Considering the last three years, Trace Group Hold actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Summing Up

While it is always sensible to investigate a company's debt, in this case Trace Group Hold has лв8.70m in net cash and a decent-looking balance sheet. So while Trace Group Hold does not have a great balance sheet, it's certainly not too bad. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 5 warning signs for Trace Group Hold you should be aware of, and 2 of them shouldn't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Trace Group Hold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:T57

Trace Group Hold

Through its subsidiaries, provides construction services for road infrastructure projects in Bulgaria and internationally.

Moderate with acceptable track record.

Market Insights

Community Narratives