Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Agria Group Holding AD (BUL:AGH) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Agria Group Holding AD

How Much Debt Does Agria Group Holding AD Carry?

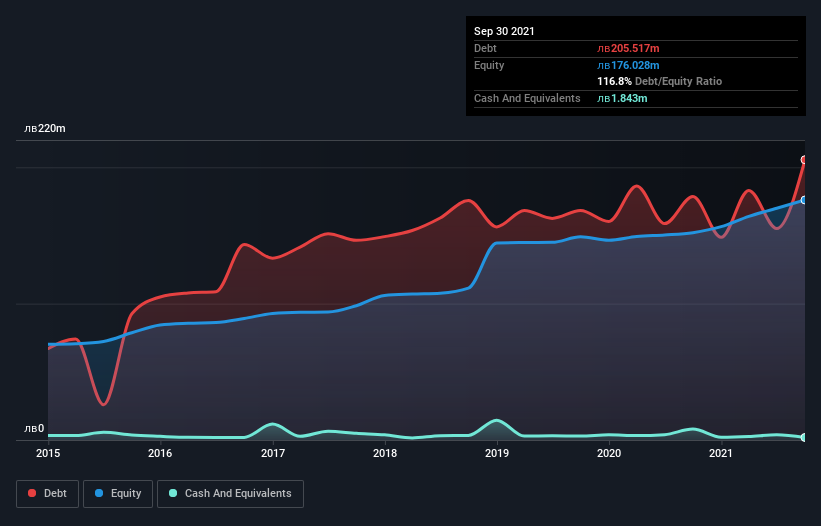

As you can see below, at the end of September 2021, Agria Group Holding AD had лв205.5m of debt, up from лв178.5m a year ago. Click the image for more detail. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Agria Group Holding AD's Balance Sheet?

We can see from the most recent balance sheet that Agria Group Holding AD had liabilities of лв186.2m falling due within a year, and liabilities of лв61.7m due beyond that. On the other hand, it had cash of лв1.84m and лв80.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by лв165.2m.

This deficit casts a shadow over the лв89.1m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Agria Group Holding AD would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

As it happens Agria Group Holding AD has a fairly concerning net debt to EBITDA ratio of 6.1 but very strong interest coverage of 12.3. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Notably, Agria Group Holding AD's EBIT launched higher than Elon Musk, gaining a whopping 224% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Agria Group Holding AD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Agria Group Holding AD created free cash flow amounting to 6.6% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On the face of it, Agria Group Holding AD's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Agria Group Holding AD has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Agria Group Holding AD (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:AGH

Agria Group Holding AD

Agria Group Holding AD, together with its subsidiaries, cultivates agricultural land, and produces and trades in grain and oil-bearing crops in the Republic of Bulgaria.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives