The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Chimimport AD (BUL:6C4) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 54% drop in the share price over that period. The more recent news is of little comfort, with the share price down 42% in a year. The good news is that the stock is up 1.6% in the last week.

See our latest analysis for Chimimport AD

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

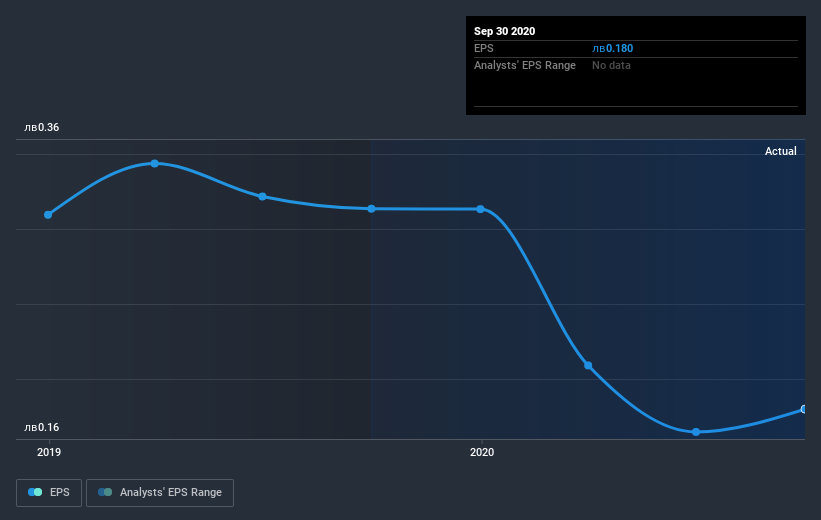

Chimimport AD saw its EPS decline at a compound rate of 7.8% per year, over the last three years. The share price decline of 23% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 5.22.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Chimimport AD's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Chimimport AD's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Chimimport AD's TSR, which was a 51% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

We regret to report that Chimimport AD shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 0.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is Chimimport AD cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BG exchanges.

When trading Chimimport AD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUL:CHIM

Chimimport AD

Engages in the acquisition, management, and sale of shares in Bulgarian and foreign companies.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives