Should You Be Adding Texim Bank AD (BUL:TXIM) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Texim Bank AD (BUL:TXIM). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Texim Bank AD

Texim Bank AD's Improving Profits

Texim Bank AD has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Texim Bank AD's EPS grew from лв0.012 to лв0.019, over the previous 12 months. It's a rarity to see 68% year-on-year growth like that.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Texim Bank AD's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Texim Bank AD's EBIT margins are flat but, worryingly, its revenue is actually down. While this may raise concerns, investors should investigate the reasoning behind this.

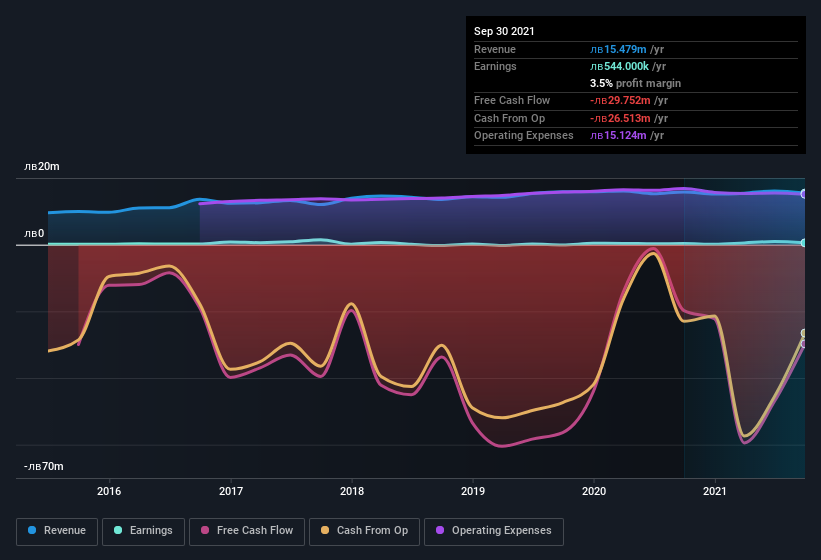

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Texim Bank AD isn't a huge company, given its market capitalisation of лв81m. That makes it extra important to check on its balance sheet strength.

Are Texim Bank AD Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations under лв369m, like Texim Bank AD, the median CEO pay is around лв85k.

The CEO of Texim Bank AD was paid just лв40k in total compensation for the year ending December 2020. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Texim Bank AD Deserve A Spot On Your Watchlist?

Texim Bank AD's earnings have taken off in quite an impressive fashion. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. We don't want to rain on the parade too much, but we did also find 4 warning signs for Texim Bank AD (1 shouldn't be ignored!) that you need to be mindful of.

Although Texim Bank AD certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Texim Bank AD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texim Bank AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:TXIM

Texim Bank AD

Provides various banking products and services to individuals and legal entities in Bulgaria.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives