Central Cooperative Bank AD's (BUL:CCB) Shareholders Are Down 47% On Their Shares

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Central Cooperative Bank AD (BUL:CCB) shareholders, since the share price is down 47% in the last three years, falling well short of the market return of around 17%.

View our latest analysis for Central Cooperative Bank AD

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

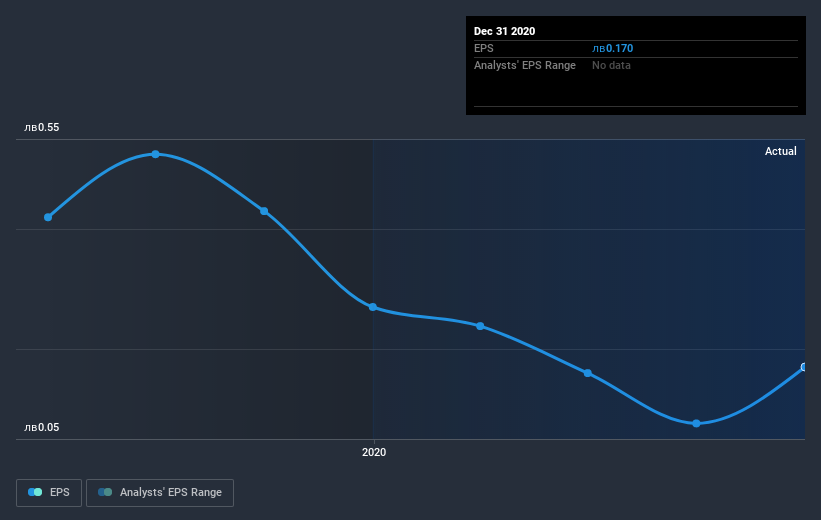

Central Cooperative Bank AD saw its EPS decline at a compound rate of 19% per year, over the last three years. So do you think it's a coincidence that the share price has dropped 19% per year, a very similar rate to the EPS? We don't. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Central Cooperative Bank AD's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Central Cooperative Bank AD has rewarded shareholders with a total shareholder return of 11% in the last twelve months. That's better than the annualised return of 0.8% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Central Cooperative Bank AD better, we need to consider many other factors. For example, we've discovered 2 warning signs for Central Cooperative Bank AD that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BG exchanges.

When trading Central Cooperative Bank AD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUL:CCB

Central Cooperative Bank AD

A commercial bank, provides various financial products and services.

Good value with proven track record.

Market Insights

Community Narratives