- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:PAY

Payton Planar Magnetics (ENXTBR:PAY) Margin Decline Challenges Bullish Profitability Narratives

Reviewed by Simply Wall St

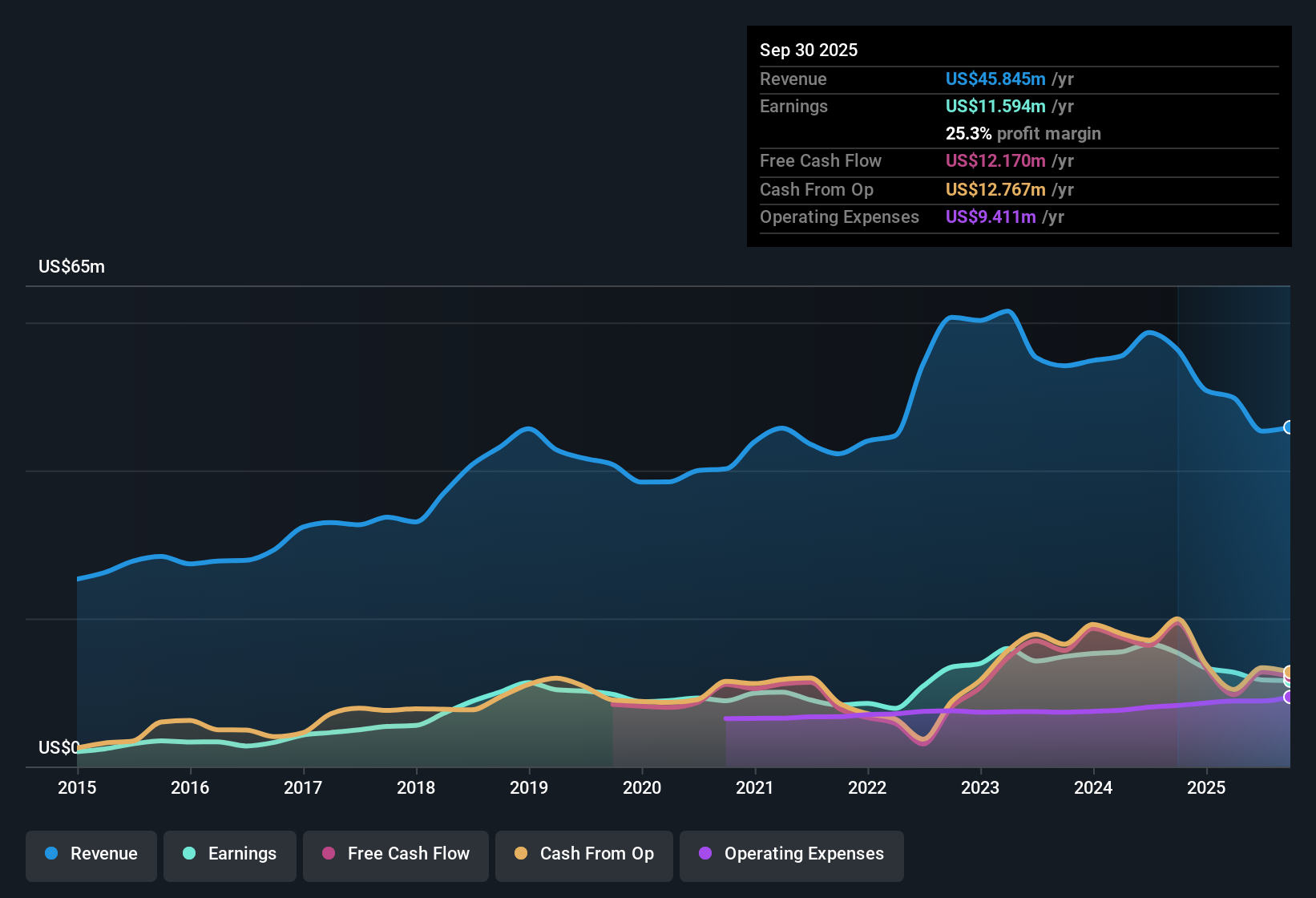

Payton Planar Magnetics (ENXTBR:PAY) has just released its Q3 2025 results, posting total revenue of $13.2 million and basic EPS of $0.20 for the quarter, with net income coming in at $3.45 million. The company has seen revenue shift over recent quarters, from $12.7 million in Q3 2024, to $9.6 million in Q4 2024. Revenue then trended up to $11.4 million and $11.6 million in the following quarters. EPS has followed a similar path, moving from $0.20 in Q3 2024, dipping to $0.12, and gradually climbing back up. Margins have shown some compression, highlighting that market expectations may be under pressure as earnings momentum shifts.

See our full analysis for Payton Planar Magnetics.Next up, we put these headline numbers in the context of the most-watched narratives around PAY, highlighting where consensus gets it right and where the latest results might reshape the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip From 27.3% to 25.3%

- Profit margins for the last twelve months landed at 25.3%, down from 27.3% the prior year. This indicates that although the company remains profitable, there has been some pressure on costs or pricing power.

- Market opinion often points to Payton’s high-quality earnings and average 9.5% annual earnings growth over five years. However, the recent margin dip brings attention to whether long-term operating efficiency can continue:

- This narrowing margin coincides with a move into negative earnings growth over the past year, raising questions around the bullish thesis that secular end-market demand will naturally support sustained profitability.

- Despite robust industry trends, the most current data opens the debate on how much longer Payton can rely on its past margin track record without more aggressive cost actions.

Valuation Remains a Bright Spot at 11.1x P/E

- Trading at 11.1x price-to-earnings, Payton’s shares appear discounted compared to both the European Electronic industry average (24.9x) and its direct peer group (17x). The current share price of €6.30 is just 0.8% below its DCF fair value of €6.35.

- Analysts emphasize that this lower-than-peer valuation, combined with persistent high-quality earnings, is a key reason value-focused investors keep Payton on their radar:

- Even with softer recent profit growth, the fact that the market values the company below calculated fair value indicates investors could still see upside if sector momentum improves or margins stabilize.

- This modest discount story is reinforced by the multi-year profitability record, challenging those who believe the margin slip alone justifies much lower multiples.

Dividend Track Record Flags Income Caution

- Payton’s dividend history is noted as unstable, which means income-oriented investors might experience more variability rather than steady payouts, despite the company’s solid earnings base.

- Upon closer analysis, this irregular dividend record contrasts with the company’s long-term earnings-growth narrative:

- While management cites five-year average EPS growth of 9.5%, income investors may be frustrated that rising profits have not resulted in predictable cash returns.

- The absence of major risk flags elsewhere reduces some concerns, but those relying on consistent dividends as part of the bullish case will need to weigh this volatility against otherwise strong headline numbers.

Long-term investors weighing these contrasting themes can see how margin pressures and dividend instability highlight the question of whether recent valuation appeal will be enough to drive renewed interest in the shares. 📊 Read the full Payton Planar Magnetics Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Payton Planar Magnetics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid past earnings, Payton’s inconsistent margins and unstable dividend record raise concerns for investors seeking reliability and predictable cash returns.

If dependable income matters most, compare your options among these 1940 dividend stocks with yields > 3% offering greater payout consistency and resilience through changing business cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:PAY

Payton Planar Magnetics

Develops, manufactures, and markets planar and conventional transformers worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026