- Israel

- /

- Food and Staples Retail

- /

- TASE:RMLI

Top Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As global markets navigate the pressures of rising U.S. Treasury yields and tepid economic growth, investors are increasingly focused on strategies that can provide stability and income in uncertain times. Dividend stocks, known for their potential to offer regular income streams, can be particularly appealing when market volatility is heightened and interest rates remain a key concern.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

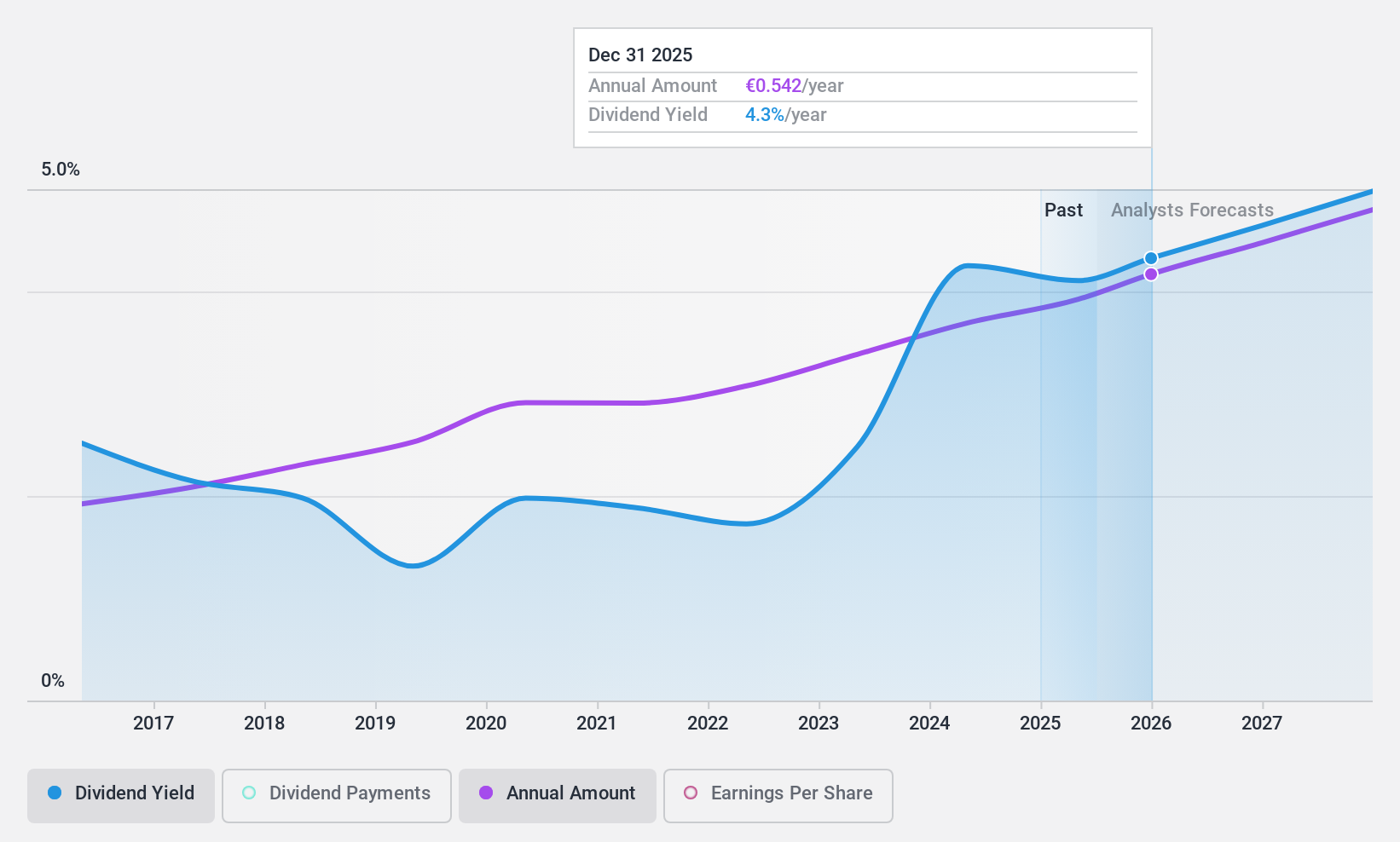

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, along with its subsidiaries, develops visualization solutions for the entertainment, enterprise, and healthcare markets across various regions including the Americas, Europe, Middle East, Africa, and Asia-Pacific; it has a market cap of €1.03 billion.

Operations: Barco NV generates its revenue from three primary segments: Entertainment (€422.79 million), Enterprise (€271.43 million), and Healthcare (€269.53 million).

Dividend Yield: 4.2%

Barco offers a stable dividend yield of 4.19%, supported by a sustainable payout ratio of 77.8% from earnings and 54.9% from cash flows, indicating reliable coverage. Over the past decade, Barco's dividends have shown stability and growth with minimal volatility. Despite trading below its estimated fair value, the yield is lower than top-tier Belgian dividend payers. Recent innovations in HDR technology could potentially enhance future revenue streams, indirectly supporting dividend sustainability.

- Click here to discover the nuances of Barco with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Barco is priced lower than what may be justified by its financials.

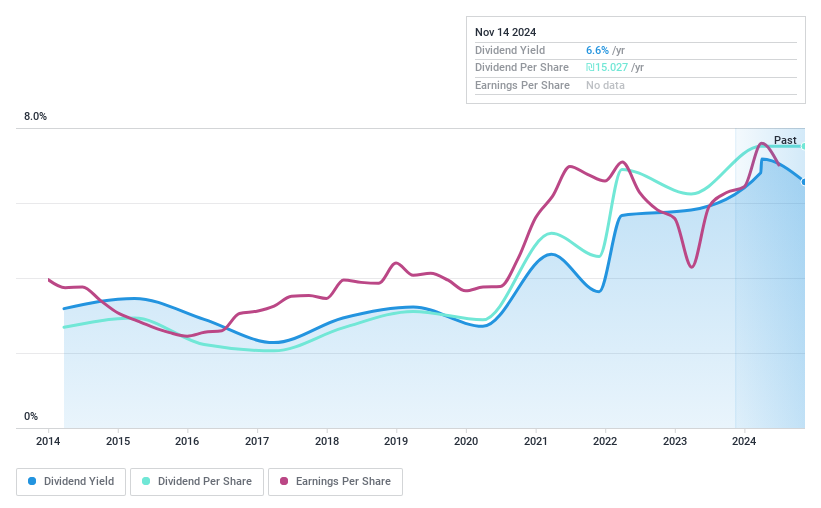

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market cap of ₪3.10 billion.

Operations: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd generates revenue primarily through its retail chains, amounting to ₪6.30 billion.

Dividend Yield: 6.7%

Rami Levi Chain Stores Hashikma Marketing 2006 offers a high dividend yield of 6.68%, ranking in the top 25% of Israeli dividend payers, but its dividends have been volatile and unreliable over the past decade. The payout ratio is high at 98.9%, indicating poor coverage by earnings, though cash flows cover it better with a lower cash payout ratio of 49.5%. Despite trading significantly below estimated fair value, sustainability concerns remain due to inconsistent earnings coverage.

- Dive into the specifics of Rami Levi Chain Stores Hashikma Marketing 2006 here with our thorough dividend report.

- Upon reviewing our latest valuation report, Rami Levi Chain Stores Hashikma Marketing 2006's share price might be too pessimistic.

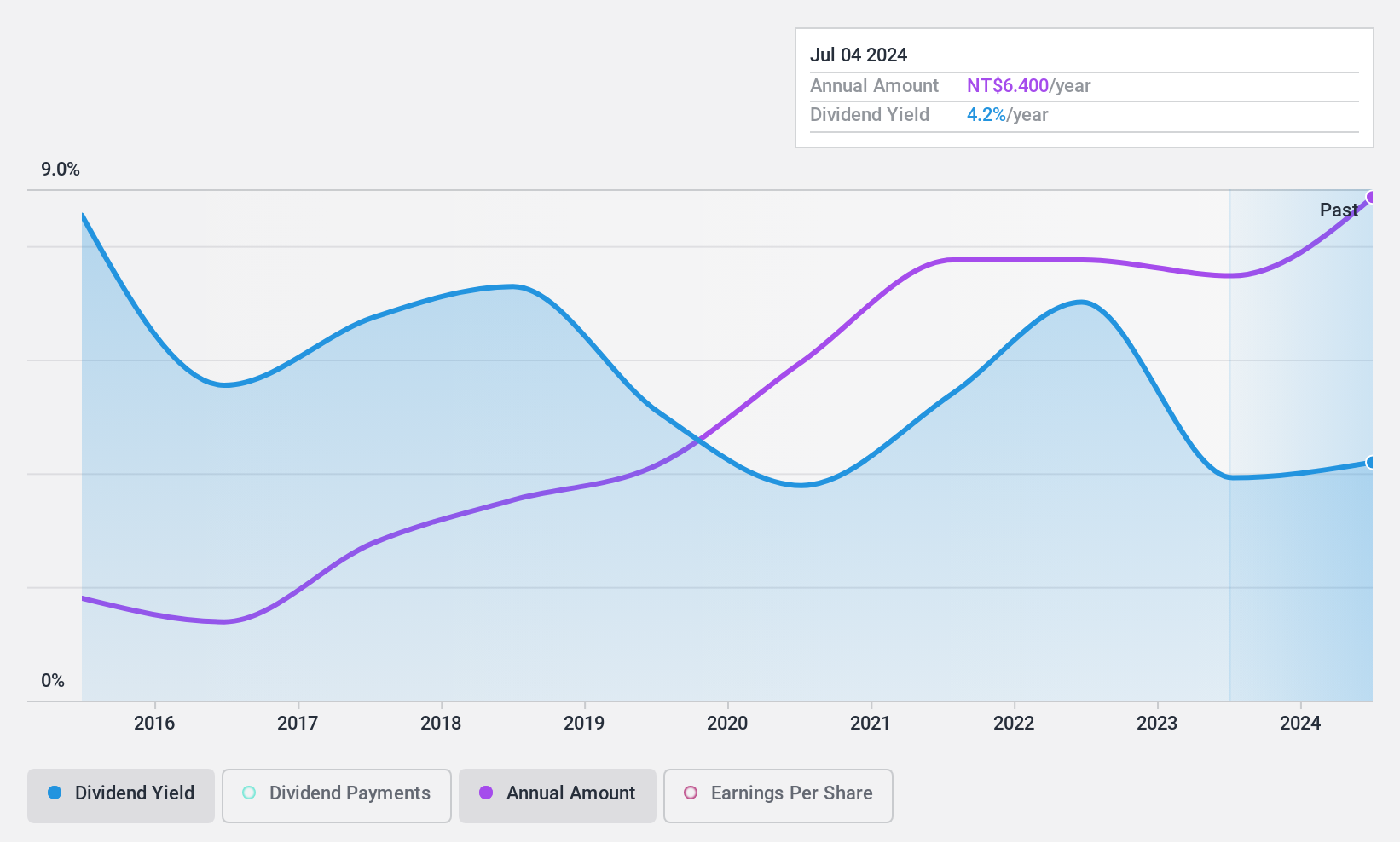

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. produces and sells electronic components, connectors, and system products across Asia, the United States, and internationally with a market cap of NT$14.15 billion.

Operations: Argosy Research Inc.'s revenue from the manufacturing and sales of electronic component products amounts to NT$3.17 billion.

Dividend Yield: 4.1%

Argosy Research's dividend yield of 4.08% is below the top 25% in its market, with a reasonable earnings payout ratio of 64.2% and cash payout ratio of 76.4%, indicating dividends are covered by both earnings and cash flows. However, the dividend track record has been volatile over the past decade despite recent growth in payments. Recent financial results show improved sales and net income, suggesting potential for stable future payouts if trends continue.

- Click here and access our complete dividend analysis report to understand the dynamics of Argosy Research.

- The valuation report we've compiled suggests that Argosy Research's current price could be quite moderate.

Summing It All Up

- Dive into all 2013 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RMLI

Rami Levi Chain Stores Hashikma Marketing 2006

Operates a chain of discount format retail stores in Israel.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives