- Belgium

- /

- Diversified Financial

- /

- ENXTBR:KEYW

Why Keyware Technologies NV’s (EBR:KEYW) Use Of Investor Capital Doesn’t Look Great

Today we'll evaluate Keyware Technologies NV (EBR:KEYW) to determine whether it could have potential as an investment idea. To be precise, we'll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

Firstly, we'll go over how we calculate ROCE. Then we'll compare its ROCE to similar companies. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. Generally speaking a higher ROCE is better. Overall, it is a valuable metric that has its flaws. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.

So, How Do We Calculate ROCE?

The formula for calculating the return on capital employed is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Keyware Technologies:

0.011 = €367k ÷ (€39m - €6.1m) (Based on the trailing twelve months to December 2019.)

So, Keyware Technologies has an ROCE of 1.1%.

See our latest analysis for Keyware Technologies

Does Keyware Technologies Have A Good ROCE?

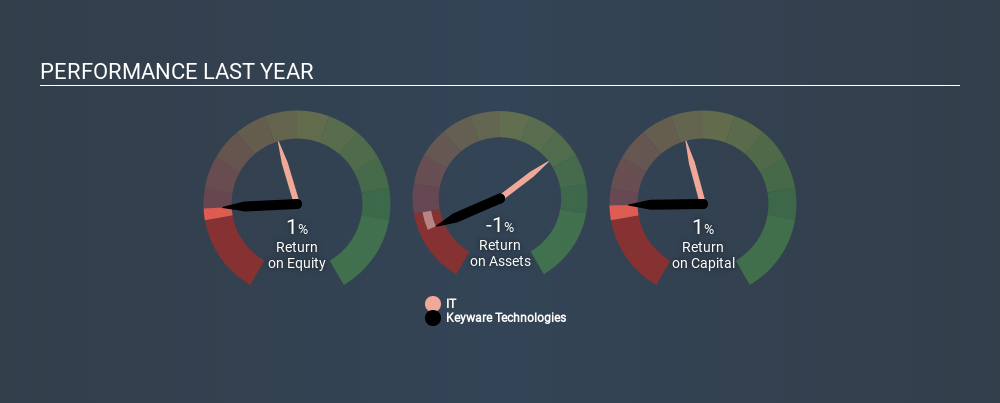

One way to assess ROCE is to compare similar companies. Using our data, Keyware Technologies's ROCE appears to be significantly below the 13% average in the IT industry. This performance is not ideal, as it suggests the company may not be deploying its capital as effectively as some competitors. Regardless of how Keyware Technologies stacks up against its industry, its ROCE in absolute terms is quite low (especially compared to a bank account). Readers may wish to look for more rewarding investments.

Keyware Technologies's current ROCE of 1.1% is lower than its ROCE in the past, which was 10%, 3 years ago. So investors might consider if it has had issues recently. You can click on the image below to see (in greater detail) how Keyware Technologies's past growth compares to other companies.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. How cyclical is Keyware Technologies? You can see for yourself by looking at this free graph of past earnings, revenue and cash flow.

What Are Current Liabilities, And How Do They Affect Keyware Technologies's ROCE?

Current liabilities are short term bills and invoices that need to be paid in 12 months or less. Due to the way ROCE is calculated, a high level of current liabilities makes a company look as though it has less capital employed, and thus can (sometimes unfairly) boost the ROCE. To counter this, investors can check if a company has high current liabilities relative to total assets.

Keyware Technologies has total assets of €39m and current liabilities of €6.1m. As a result, its current liabilities are equal to approximately 15% of its total assets. With a very reasonable level of current liabilities, so the impact on ROCE is fairly minimal.

Our Take On Keyware Technologies's ROCE

While that is good to see, Keyware Technologies has a low ROCE and does not look attractive in this analysis. Of course, you might also be able to find a better stock than Keyware Technologies. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTBR:KEYW

Keyware Technologies

Provides electronic payments processing and management solutions in Belgium.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)