The one-year earnings decline is not helping Hybrid Software Group's (EBR:HYSG share price, as stock falls another 12% in past week

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Hybrid Software Group PLC (EBR:HYSG) shareholders over the last year, as the share price declined 41%. That contrasts poorly with the market decline of 2.1%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 15% in three years. Shareholders have had an even rougher run lately, with the share price down 17% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Hybrid Software Group

While Hybrid Software Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Hybrid Software Group's revenue didn't grow at all in the last year. In fact, it fell 0.1%. That looks pretty grim, at a glance. The stock price has languished lately, falling 41% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

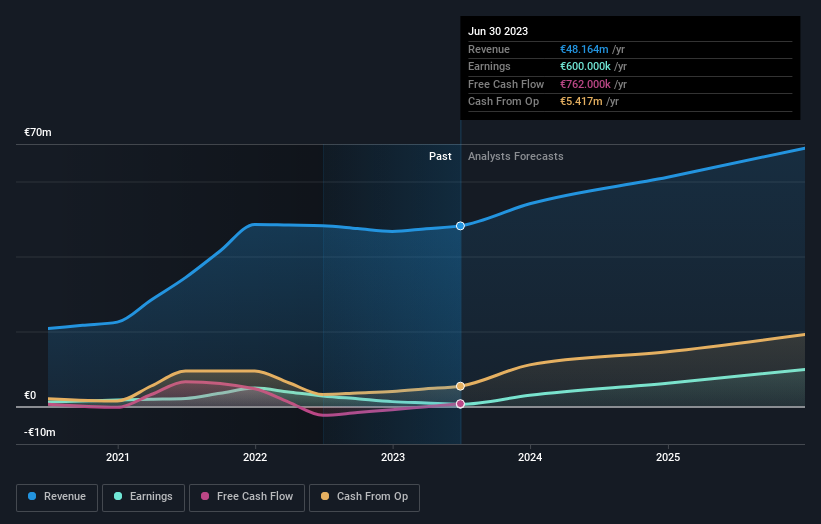

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Hybrid Software Group's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Hybrid Software Group had a tough year, with a total loss of 41%, against a market gain of about 2.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Hybrid Software Group is showing 4 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Belgian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hybrid Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:HYSG

Hybrid Software Group

Develops software and hardware technology solutions for graphics and industrial inkjet printing in the United Kingdom, rest of Europe, North and South America, and Asia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives