- Taiwan

- /

- Construction

- /

- TPEX:8936

Undiscovered Gems Promising Stocks To Explore In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are reflecting a mixed sentiment with U.S. stocks closing another strong year despite recent slumps, while economic indicators like the Chicago PMI highlight ongoing challenges in manufacturing. Amidst this backdrop of fluctuating indices and revised GDP forecasts, small-cap stocks present unique opportunities for investors seeking potential growth beyond the mainstream options. In this environment, identifying promising stocks involves looking for companies that not only demonstrate resilience in challenging economic conditions but also have innovative strategies or niche market positions that could drive future success.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Econocom Group (ENXTBR:ECONB)

Simply Wall St Value Rating: ★★★★★★

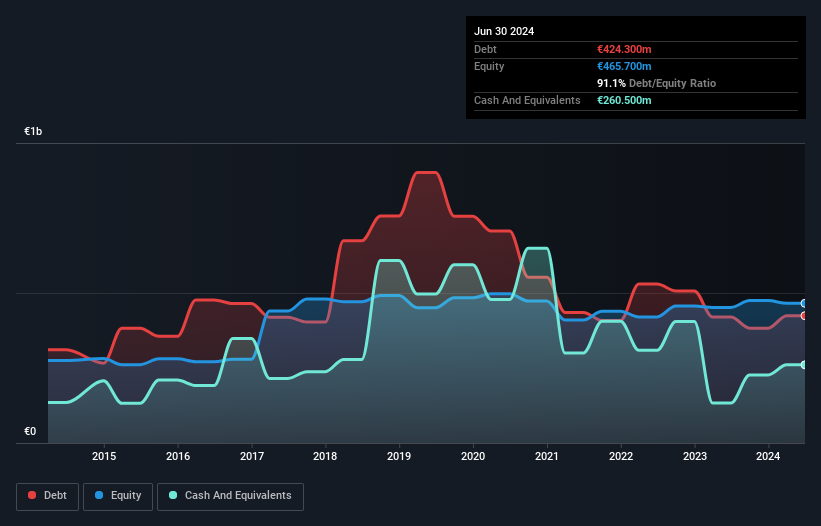

Overview: Econocom Group SE specializes in conceiving, financing, and facilitating digital transformation for large firms and public organizations both in Belgium and internationally, with a market cap of approximately €333.43 million.

Operations: Econocom Group's revenue streams include Services (€542.80 million), Products & Solutions (€1.43 billion), and Technology Management & Financing (TMF) (€1.04 billion). The company also reports internal revenue adjustments of -€283.70 million, affecting its overall financial results. The diverse revenue model highlights significant contributions from the Products & Solutions and TMF segments, indicating a focus on comprehensive digital transformation offerings for clients across various sectors.

Econocom, a player in the IT sector, boasts a net debt to equity ratio of 35.2%, which is quite satisfactory. The company trades at 14.9% below its estimated fair value, suggesting potential upside for investors looking for value plays. Its interest payments are well covered by EBIT with a coverage ratio of 7.7x, indicating strong financial health in managing debt obligations. Over the past year, earnings growth hit an impressive 65.4%, significantly outpacing the industry average of just 0.09%. With high-quality past earnings and positive free cash flow, Econocom seems positioned for continued stability and growth.

- Click here to discover the nuances of Econocom Group with our detailed analytical health report.

Gain insights into Econocom Group's past trends and performance with our Past report.

Bait Bakfar (TASE:BKFR)

Simply Wall St Value Rating: ★★★★☆☆

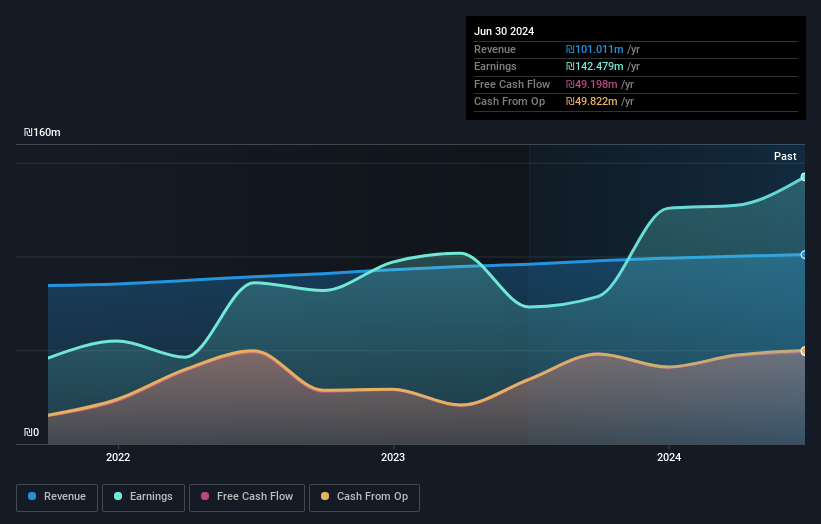

Overview: Bait Bakfar Ltd manages and operates sheltered housing complexes in Israel with a market capitalization of ₪1.03 billion.

Operations: Bait Bakfar generates revenue primarily from personal services, with a reported income of ₪102.08 million.

Bait Bakfar, a nimble player in its field, reported sales of ILS 26.13 million for Q3 2024, up from ILS 25.07 million the previous year. Despite this increase, net income dipped to ILS 3.91 million from ILS 6.99 million due to a significant one-off gain of ₪152.8M affecting the annual results as of September 30th, 2024. However, earnings surged by an impressive 77% over the past year, outpacing the Healthcare industry's growth rate of just under 8%. With no debt on its books and a favorable price-to-earnings ratio at just over half the market average (7.4x), Bait Bakfar stands out for potential investors looking for value in smaller companies within Israel's market landscape.

- Get an in-depth perspective on Bait Bakfar's performance by reading our health report here.

Review our historical performance report to gain insights into Bait Bakfar's's past performance.

Kuo Toong International (TPEX:8936)

Simply Wall St Value Rating: ★★★★★☆

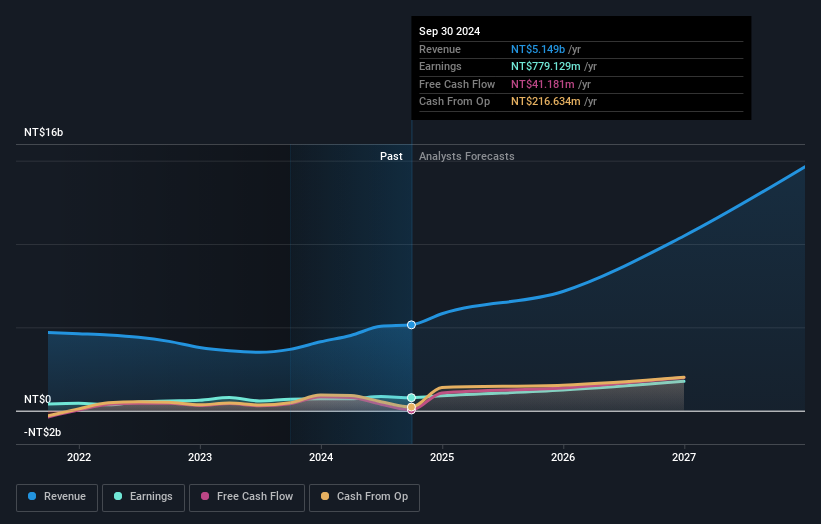

Overview: Kuo Toong International Co., Ltd. specializes in the design, production, and assembly of water supply and division pipes in Taiwan and Mainland China, with a market capitalization of NT$12.48 billion.

Operations: Kuo Toong International generates revenue primarily from its Guotong segment, contributing NT$4.31 billion, and the Guoyang segment, adding NT$582.01 million. The company's net profit margin shows a notable trend over recent periods.

Kuo Toong International, a construction industry player, has been making waves with its recent performance. The company reported a notable earnings growth of 12.9% over the past year, outpacing the industry's 9.3%. Its net debt to equity ratio stands at a satisfactory 25.1%, having decreased from 58.7% five years ago, indicating improved financial health. Recent contracts worth NTD 433 million highlight its active engagement in significant projects like the Second Cross-Harbor Main Sewer and Taichung-Yunlin water pipeline projects. Despite a dip in quarterly net income to TWD 179 million from TWD 246 million last year, Kuo Toong's sales for nine months rose impressively to TWD 3,812 million from TWD 2,795 million previously, showcasing strong revenue momentum despite challenges in profitability metrics such as basic EPS dropping to TWD 0.72 from TWD 0.99 per share compared to last year’s quarter figures.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4670 more companies for you to explore.Click here to unveil our expertly curated list of 4673 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuo Toong International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8936

Kuo Toong International

Engages in the design, production, and assembly of water supply and division pipes in Taiwan and Mainland China.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives